Question: Arbitrage funds available = $6,000,500; Spot exchange rate (Kr/$) = 6.1430; 3-month forward rate (Kr/$) = 6.1720; US dollar 3-month interest rate = 3.100%

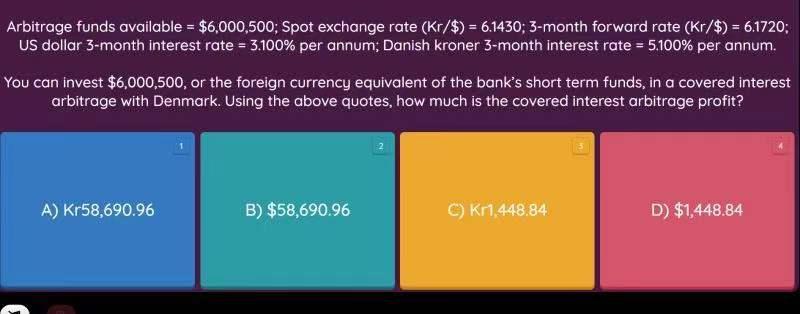

Arbitrage funds available = $6,000,500; Spot exchange rate (Kr/$) = 6.1430; 3-month forward rate (Kr/$) = 6.1720; US dollar 3-month interest rate = 3.100% per annum; Danish kroner 3-month interest rate = 5.100% per annum. You can invest $6,000,500, or the foreign currency equivalent of the bank's short term funds, in a covered interest arbitrage with Denmark. Using the above quotes, how much is the covered interest arbitrage profit? A) Kr58,690.96 B) $58,690.96 C) Kr1,448.84 D) $1,448.84

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Answert STEP1 A strategy in which arbitrager reduces rate risk by using the diff... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635e0d38ec88d_181034.pdf

180 KBs PDF File

635e0d38ec88d_181034.docx

120 KBs Word File