Question: Time Value Personal Finance Problem Misty needs to have $15,000 in 8 years to fulfill her goal of purchasing a small sailboat. She is willing

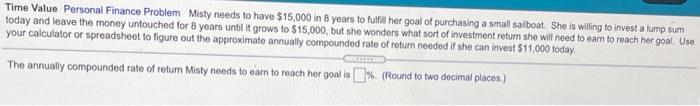

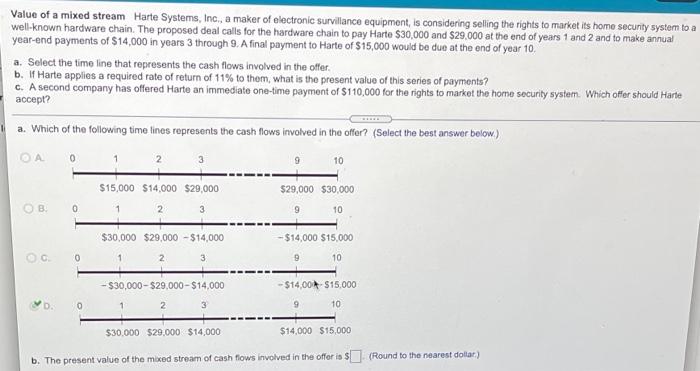

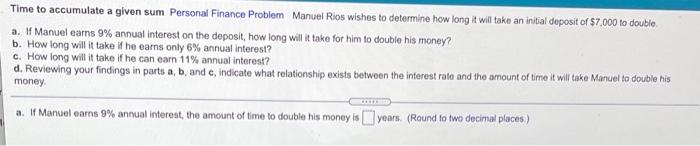

Time Value Personal Finance Problem Misty needs to have $15,000 in 8 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 8 years until it grows to $15,000, but she wonder what sort of investment return she will need to eam to reach her goal Use your calculator or spreadsheet to figure out the approximate annually compounded rate of return needed if she can invest $11,000 today. The annually compounded rate of return Misty needs to earn to reach her goal is 5% (Round to two decimal places.) Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $30,000 and $29.000 at the end of years 1 and 2 and to make annual year-end payments of $14,000 in years 3 through 9. A final payment to Harte of $15,000 would be due at the end of year 10 a. Select the time line that represents the cash flows involved in the offer. b. If Harte applies a required rate of return of 11% to them, what is the present value of this series of payments? c. A second company has offered Harte an immediate one-time payment of $110,000 for the rights to market the home security system. Which offer should Harte accept? a. Which of the following time lines represents the cash flows involved in the offer? (Select the best answer below) 0 2 10 $15,000 $14,000 $29,000 $29,000 $30,000 9 10 B 0 $30,000 $29,000 - $14,000 $14,000 $15,000 0 2 3 9 10 $30,000-$29,000-$14,000 $14,00 $15,000 0 1 2 3 9 10 $30.000 $20,000 $14,000 $14,000 $15,000 b. The present value of the mixed stream of cash flows involved in the offer is $(Round to the nearest dollar) Time to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $7.000 to double a. If Manuel carns 9% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 6% annual interest? c. How long will it take if he can earn 11% annual interest? d. Reviewing your findings in parts a, b, and e, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money a. If Manuel earns 9% annual interest, the amount of time to double his money is years. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts