Question: Timed, quick please Question 1 (a) You are appointed as a financial consultant for a listed company. You are to evaluate the company's common stock

Timed, quick please

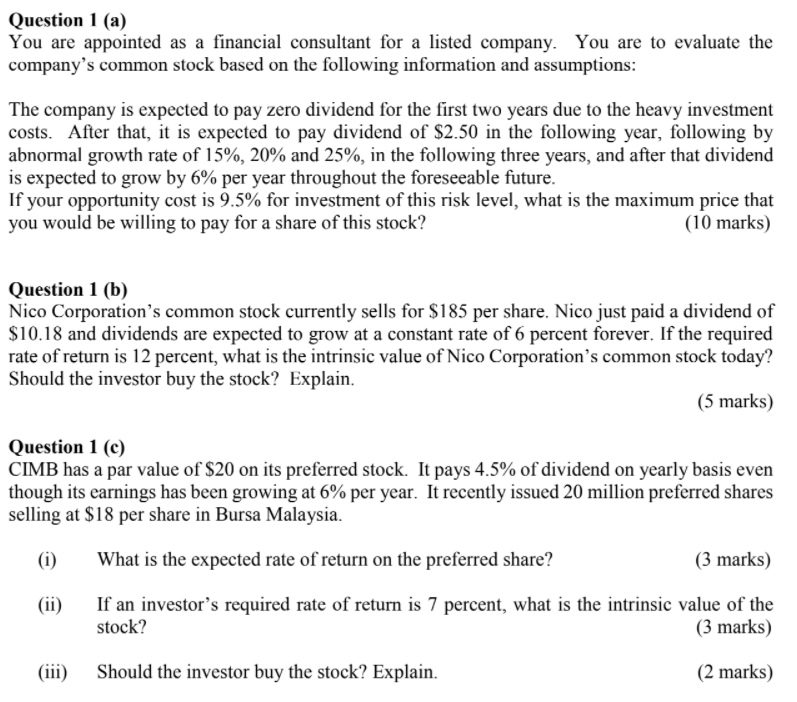

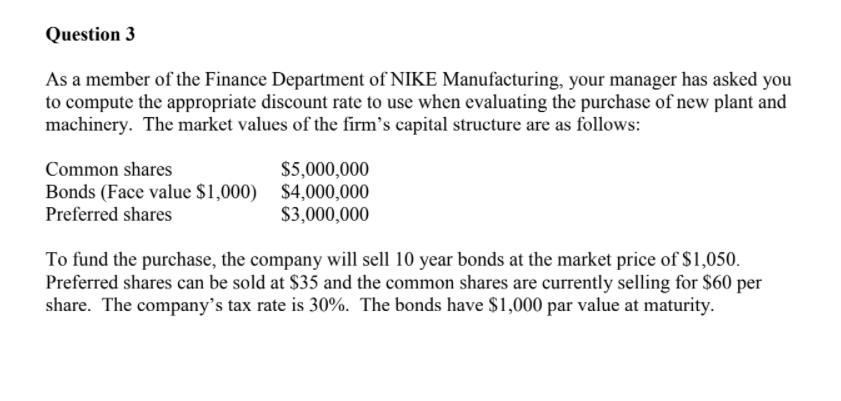

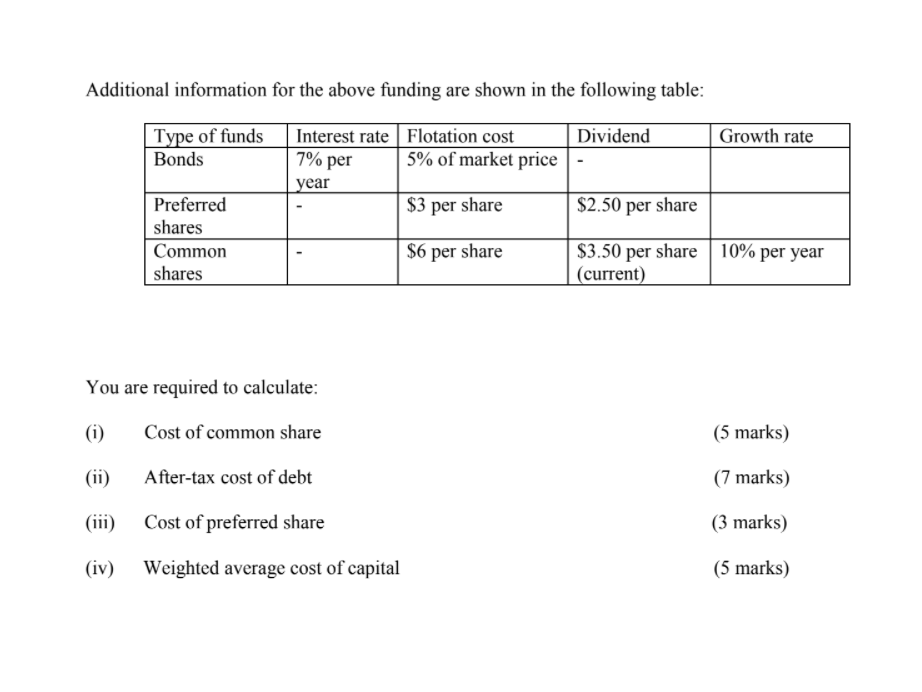

Question 1 (a) You are appointed as a financial consultant for a listed company. You are to evaluate the company's common stock based on the following information and assumptions: The company is expected to pay zero dividend for the first two years due to the heavy investment costs. After that, it is expected to pay dividend of $2.50 in the following year, following by abnormal growth rate of 15%, 20% and 25%, in the following three years, and after that dividend is expected to grow by 6% per year throughout the foreseeable future. If your opportunity cost is 9.5% for investment of this risk level, what is the maximum price that you would be willing to pay for a share of this stock? (10 marks) Question 1 (b) Nico Corporation's common stock currently sells for $185 per share. Nico just paid a dividend of $10.18 and dividends are expected to grow at a constant rate of 6 percent forever. If the required rate of return is 12 percent, what is the intrinsic value of Nico Corporation's common stock today? Should the investor buy the stock? Explain. (5 marks) Question 1 (c) CIMB has a par value of $20 on its preferred stock. It pays 4.5% of dividend on yearly basis even though its earnings has been growing at 6% per year. It recently issued 20 million preferred shares selling at $18 per share in Bursa Malaysia. (i) What is the expected rate of return on the preferred share? (3 marks) (ii) If an investor's required rate of return is 7 percent, what is the intrinsic value of the stock? (3 marks) (iii) Should the investor buy the stock? Explain. (2 marks) Question 3 As a member of the Finance Department of NIKE Manufacturing, your manager has asked you to compute the appropriate discount rate to use when evaluating the purchase of new plant and machinery. The market values of the firm's capital structure are as follows: Common shares $5,000,000 Bonds (Face value $1,000) $4,000,000 Preferred shares $3,000,000 To fund the purchase, the company will sell 10 year bonds at the market price of $1,050. Preferred shares can be sold at $35 and the common shares are currently selling for $60 per share. The company's tax rate is 30%. The bonds have $1,000 par value at maturity. Additional information for the above funding are shown in the following table: Dividend Growth rate Type of funds Bonds Interest rate Flotation cost 7% per 5% of market price year $3 per share $2.50 per share Preferred shares Common shares $6 per share $3.50 per share 10% per year (current) You are required to calculate: (i) Cost of common share (5 marks) (ii) After-tax cost of debt (7 marks) (3 marks) (iii) Cost of preferred share (iv) Weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts