Question: timed task, please answer for an upvote :)) A donor gave the following donations during 2021: Jan 24- land located in Quezon City valued at

timed task, please answer for an upvote :))

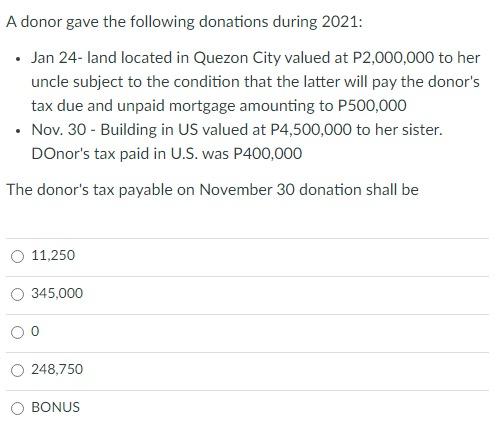

A donor gave the following donations during 2021: Jan 24- land located in Quezon City valued at P2,000,000 to her uncle subject to the condition that the latter will pay the donor's tax due and unpaid mortgage amounting to P500,000 Nov. 30 - Building in US valued at P4,500,000 to her sister. DOnor's tax paid in U.S. was P400,000 The donor's tax payable on November 30 donation shall be 11.250 345.000 248,750 BONUS A donor gave the following donations during 2021: Jan 24- land located in Quezon City valued at P2,000,000 to her uncle subject to the condition that the latter will pay the donor's tax due and unpaid mortgage amounting to P500,000 Nov. 30 - Building in US valued at P4,500,000 to her sister. DOnor's tax paid in U.S. was P400,000 The donor's tax payable on November 30 donation shall be 11.250 345.000 248,750 BONUS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts