Question: timed task, please answer for an upvote :)) A non-resident Australian, married, died and left the following proeprties: Philippines 3,000,000 8,500,000 Australia 8,000,000 15,000,000 500,000

timed task, please answer for an upvote :))

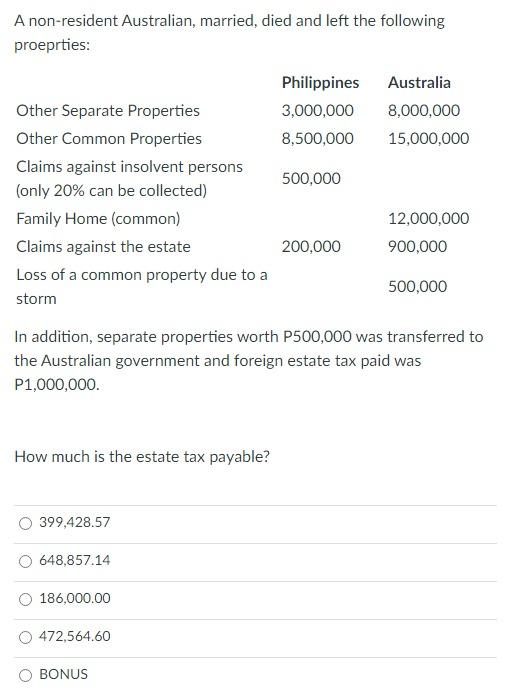

A non-resident Australian, married, died and left the following proeprties: Philippines 3,000,000 8,500,000 Australia 8,000,000 15,000,000 500,000 Other Separate Properties Other Common Properties Claims against insolvent persons (only 20% can be collected) Family Home (common) Claims against the estate Loss of a common property due to a storm 12,000,000 900,000 200,000 500,000 In addition, separate properties worth P500,000 was transferred to the Australian government and foreign estate tax paid was P1,000,000. How much is the estate tax payable? 399,428.57 648,857.14 186,000.00 472,564.60 BONUS A non-resident Australian, married, died and left the following proeprties: Philippines 3,000,000 8,500,000 Australia 8,000,000 15,000,000 500,000 Other Separate Properties Other Common Properties Claims against insolvent persons (only 20% can be collected) Family Home (common) Claims against the estate Loss of a common property due to a storm 12,000,000 900,000 200,000 500,000 In addition, separate properties worth P500,000 was transferred to the Australian government and foreign estate tax paid was P1,000,000. How much is the estate tax payable? 399,428.57 648,857.14 186,000.00 472,564.60 BONUS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts