Question: timed task, please answer for an upvote :)) In 2021, a construction company entered into a contract with the government to construct a building for

timed task, please answer for an upvote :))

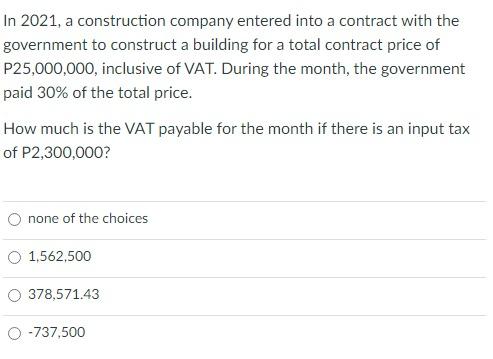

In 2021, a construction company entered into a contract with the government to construct a building for a total contract price of P25,000,000, inclusive of VAT. During the month, the government paid 30% of the total price. How much is the VAT payable for the month if there is an input tax of P2,300,000? O none of the choices 1,562.500 0 378,571.43 0-737,500 In 2021, a construction company entered into a contract with the government to construct a building for a total contract price of P25,000,000, inclusive of VAT. During the month, the government paid 30% of the total price. How much is the VAT payable for the month if there is an input tax of P2,300,000? O none of the choices 1,562.500 0 378,571.43 0-737,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts