Question: timed task, pls help thanks! about transfer taxes Mr. & Mrs. Smith (American citizens residing in the US) made the following donations on April 18,

timed task, pls help thanks!

about transfer taxes

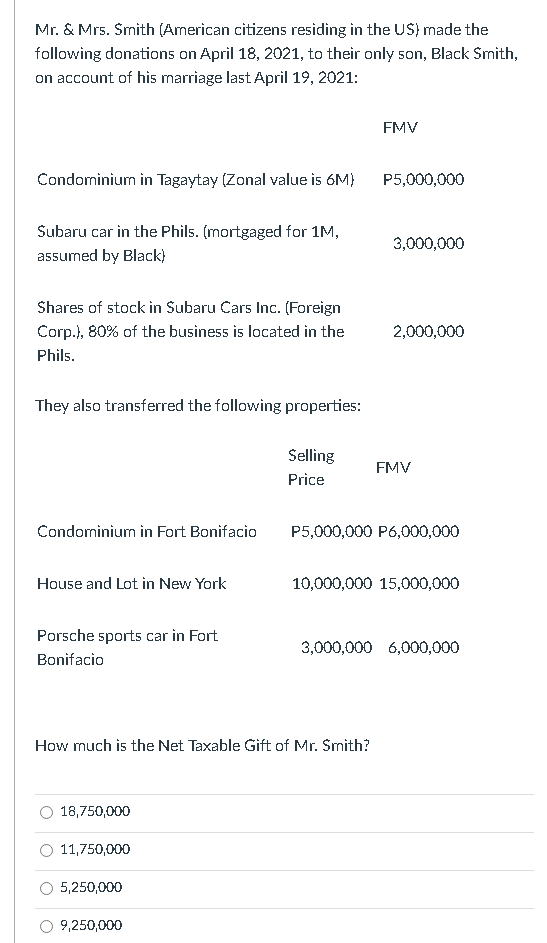

Mr. & Mrs. Smith (American citizens residing in the US) made the following donations on April 18, 2021, to their only son, Black Smith, on account of his marriage last April 19, 2021: FMV Condominium in Tagaytay (Zonal value is 6M) P5,000,000 Subaru car in the Phils. (mortgaged for 1M, assumed by Black) 3,000,000 Shares of stock in Subaru Cars Inc. (Foreign Corp.), 80% of the business is located in the Phils. 2,000,000 They also transferred the following properties: Selling Price FMV Condominium in Fort Bonifacio P5,000,000 P6,000,000 House and Lot in New York 10,000,000 15,000,000 Porsche sports car in Fort Bonifacio 3,000,000 6,000,000 How much is the Net Taxable Gift of Mr. Smith? 18,750,000 O 11,750,000 5,250,000 O 9,250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts