Question: Times New... 10 . A A LA Copy Tout e neral L109 x f A B C D E F G H I J K

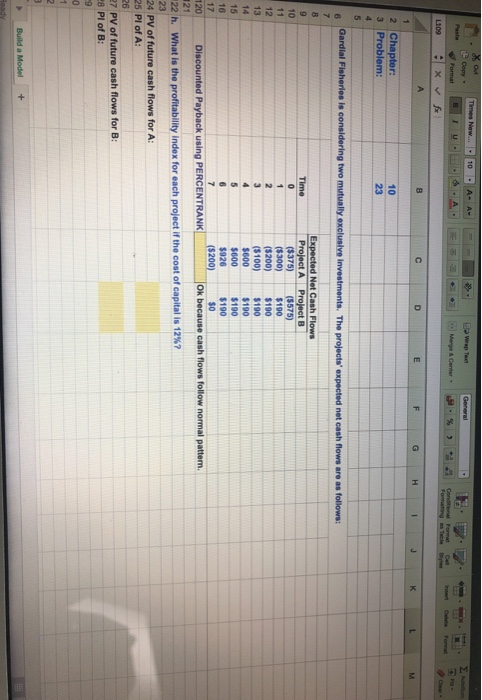

Times New... 10 . A A LA Copy Tout e neral L109 x f A B C D E F G H I J K L M 2 Chapter: Problem: 23 Gardial Fisheries is considering two mutually exclusive Investments. The projects' expected net cash flows are as follows: $190 Expected Net Cash Flows Project A Project B ($375) (5575) ($300) $100 ($200) ($100) $190 S600 $190 $600 $190 $926 $190 ($200) Ok because cash flows follow normal pattem. Discounted Payback using PERCENTRANK 22 h. What is the profitability Index for each project if the cost of capital is 12%? 23 24 PV of future cash flows for A: 25 PI of A: 27 PV of future cash flows for B: 28 Pl of B: Build a Model +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts