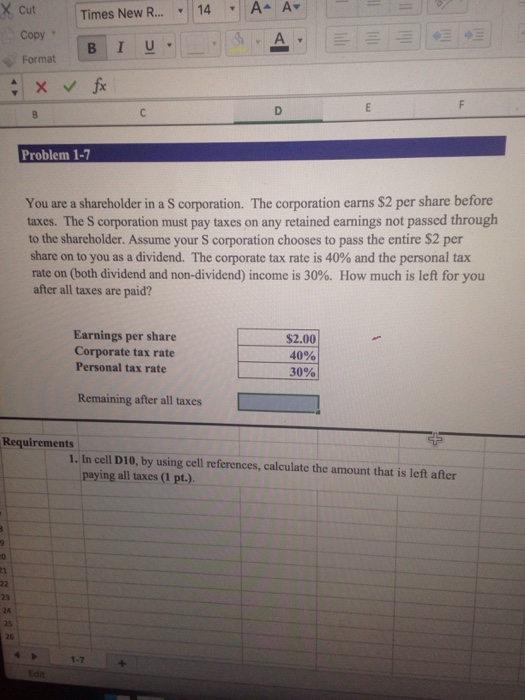

Question: Times New R ? 14 , A^ A? Copy Format Problem 1-7 You are a shareholder in a S corporation. The corporation earns $2 per

Times New R ? 14 , A^ A? Copy" Format Problem 1-7 You are a shareholder in a S corporation. The corporation earns $2 per share before taxes. The S corporation must pay taxes on any retained earnings not passed through to the shareholder. Assume your S corporation chooses to pass the entire $2 per share on to you as a dividend. The corporate tax rate is 40% and the personal tax rate on (both dividend and non-dividend) income is 30%. How much is left for you after all taxes are paid? Earnings per share Corporate tax rate Personal tax rate $2.00 40% 30% Remaining after all taxes Requirements 1. In cell D10, by using cell references, calculate the amount that is left after paying all taxes (1 pt.). 23 24 25 26 1-7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts