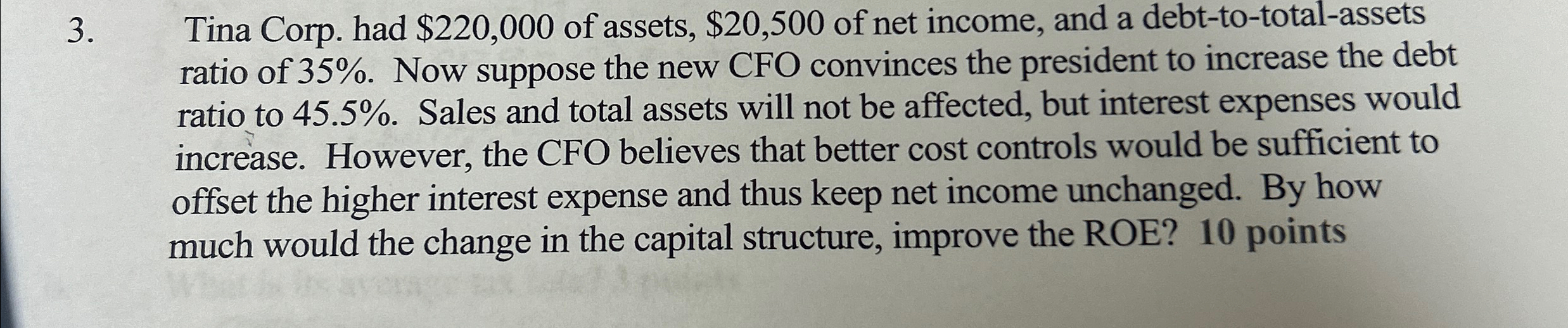

Question: Tina Corp. had $ 2 2 0 , 0 0 0 of assets, $ 2 0 , 5 0 0 of net income, and a

Tina Corp. had $ of assets, $ of net income, and a debttototalassets ratio of Now suppose the new CFO convinces the president to increase the debt ratio to Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure, improve the ROE? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock