Question: Tinas T1 form. The form must be prepared manually, either by hand or typed 1. Tina Taxpayer is a 39-year old resident of Richmond with

Tinas T1 form. The form must be prepared manually, either by hand or typed

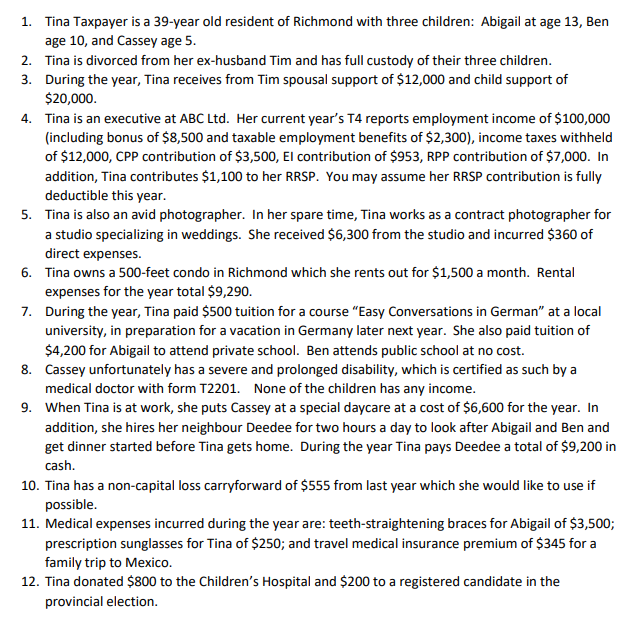

1. Tina Taxpayer is a 39-year old resident of Richmond with three children: Abigail at age 13, Ben age 10 , and Cassey age 5. 2. Tina is divorced from her ex-husband Tim and has full custody of their three children. 3. During the year, Tina receives from Tim spousal support of $12,000 and child support of $20,000. 4. Tina is an executive at ABC Ltd. Her current year's T4 reports employment income of $100,000 (including bonus of $8,500 and taxable employment benefits of $2,300 ), income taxes withheld of $12,000, CPP contribution of $3,500, El contribution of $953, RPP contribution of $7,000. In addition, Tina contributes $1,100 to her RRSP. You may assume her RRSP contribution is fully deductible this year. 5. Tina is also an avid photographer. In her spare time, Tina works as a contract photographer for a studio specializing in weddings. She received $6,300 from the studio and incurred $360 of direct expenses. 6. Tina owns a 500-feet condo in Richmond which she rents out for $1,500 a month. Rental expenses for the year total $9,290. 7. During the year, Tina paid $500 tuition for a course "Easy Conversations in German" at a local university, in preparation for a vacation in Germany later next year. She also paid tuition of $4,200 for Abigail to attend private school. Ben attends public school at no cost. 8. Cassey unfortunately has a severe and prolonged disability, which is certified as such by a medical doctor with form T2201. None of the children has any income. 9. When Tina is at work, she puts Cassey at a special daycare at a cost of $6,600 for the year. In addition, she hires her neighbour Deedee for two hours a day to look after Abigail and Ben and get dinner started before Tina gets home. During the year Tina pays Deedee a total of $9,200 in cash. 10. Tina has a non-capital loss carryforward of $555 from last year which she would like to use if possible. 11. Medical expenses incurred during the year are: teeth-straightening braces for Abigail of $3,500; prescription sunglasses for Tina of $250; and travel medical insurance premium of $345 for a family trip to Mexico. 12. Tina donated $800 to the Children's Hospital and $200 to a registered candidate in the provincial election

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts