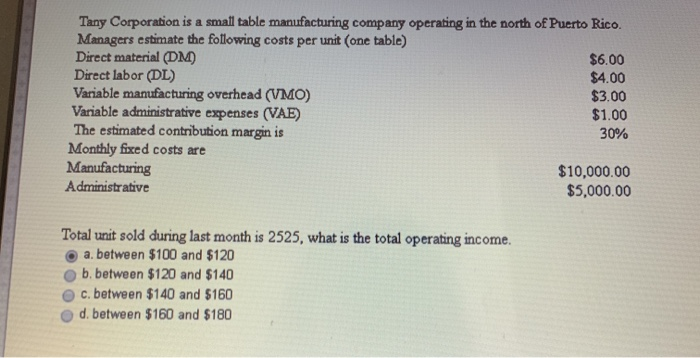

Question: Tiny Corporation is a small table manufacturing company operating in the north of Puerto Rico. Managers estimate the following costs per unit (one table) Direct

Tiny Corporation is a small table manufacturing company operating in the north of Puerto Rico. Managers estimate the following costs per unit (one table) Direct material (DM) $6.00 Direct labor (DL) $4.00 Variable manufacturing overhead (VMO) $3.00 Variable administrative expenses (VAE) $1.00 The estimated contribution margin is 30% Monthly fixed costs are Manufacturing $10,000.00 Administrative $5,000.00 Total unit sold during last month is 2525, what is the total operating income. a. between $100 and $120 b. between $120 and $140 c. between $140 and $160 d. between $160 and $180

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock