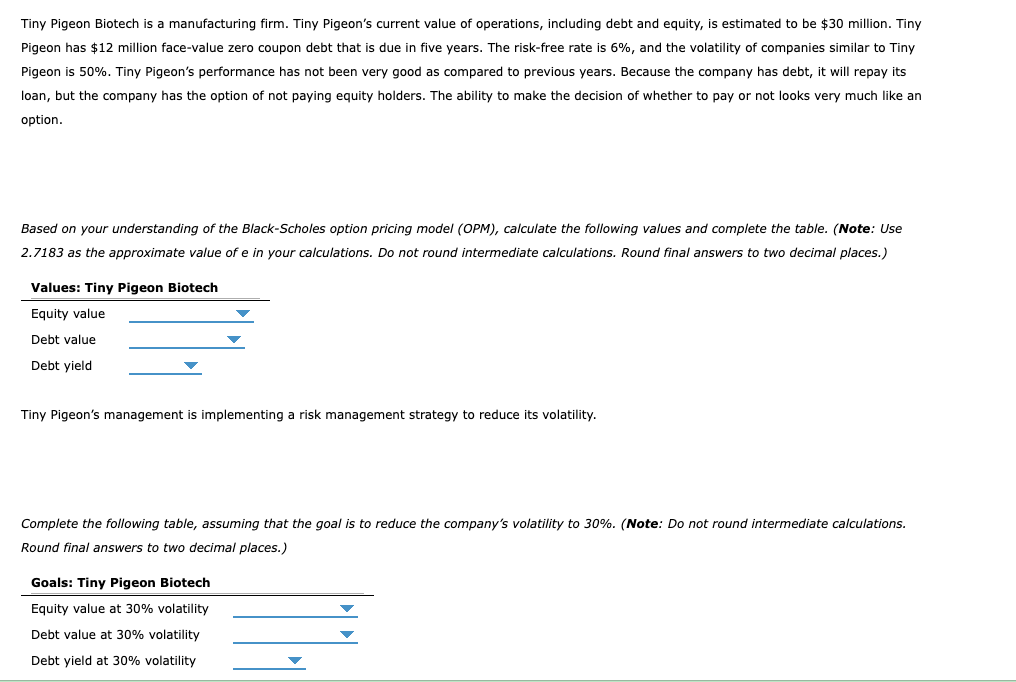

Question: Tiny Pigeon Biotech is a manufacturing firm. Tiny Pigeon's current value of operations, including debt and equity, is estimated to be $30 million. Tiny option.

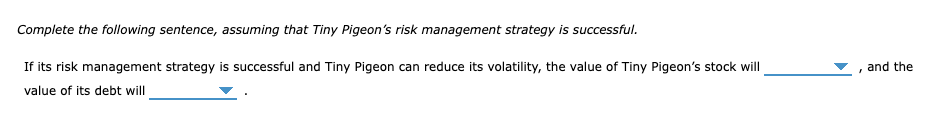

Tiny Pigeon Biotech is a manufacturing firm. Tiny Pigeon's current value of operations, including debt and equity, is estimated to be $30 million. Tiny option. Based on your understanding of the Black-Scholes option pricing model (OPM), calculate the following values and complete the the 2.7183 as the approximate value of e in your calculations. Do not round intermediate calculations. Round final answers to two decimal Tiny Pigeon's management is implementing a risk management strategy to reduce its volatility. Complete the following table, assuming that the goal is to reduce the company's volatility to 30%. (Note: Do not round intermediate calculations. Round final answers to two decimal places.) Complete the following sentence, assuming that Tiny Pigeon's risk management strategy is successful. If its risk management strategy is successful and Tiny Pigeon can reduce its volatility, the value of Tiny Pigeon's stock will , and the value of its debt will Tiny Pigeon Biotech is a manufacturing firm. Tiny Pigeon's current value of operations, including debt and equity, is estimated to be $30 million. Tiny option. Based on your understanding of the Black-Scholes option pricing model (OPM), calculate the following values and complete the the 2.7183 as the approximate value of e in your calculations. Do not round intermediate calculations. Round final answers to two decimal Tiny Pigeon's management is implementing a risk management strategy to reduce its volatility. Complete the following table, assuming that the goal is to reduce the company's volatility to 30%. (Note: Do not round intermediate calculations. Round final answers to two decimal places.) Complete the following sentence, assuming that Tiny Pigeon's risk management strategy is successful. If its risk management strategy is successful and Tiny Pigeon can reduce its volatility, the value of Tiny Pigeon's stock will , and the value of its debt will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts