Question: Tiny Tots Transit has 3 operating divisions Cam, Nate and Ash. Corporate headquarters in Tuscaloosa incurs $3,500,000 per period which the company considers as

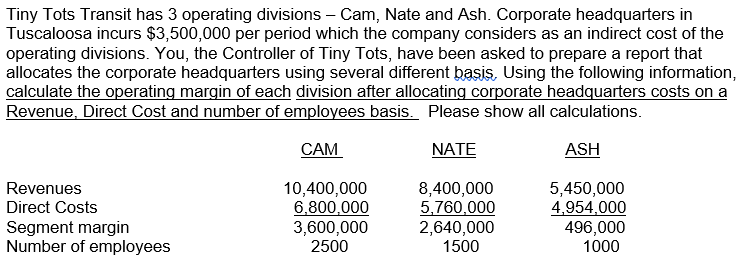

Tiny Tots Transit has 3 operating divisions Cam, Nate and Ash. Corporate headquarters in Tuscaloosa incurs $3,500,000 per period which the company considers as an indirect cost of the operating divisions. You, the Controller of Tiny Tots, have been asked to prepare a report that allocates the corporate headquarters using several different basis, Using the following information, calculate the operating margin of each division after allocating corporate headquarters costs on a Revenue, Direct Cost and number of employees basis. Please show all calculations. CAM NATE ASH Revenues 10,400,000 6,800,000 3,600,000 2500 8,400,000 5,760,000 2,640,000 1500 5,450,000 4,954,000 496,000 1000 Direct Costs Segment margin Number of employees

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Operating Margin CAM NATE ASH Revenues 10400000 8400000 5450000 Direct Costs 6800000 5760000 4954000 ... View full answer

Get step-by-step solutions from verified subject matter experts