Question: tion Completion Status: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Moving to another question will

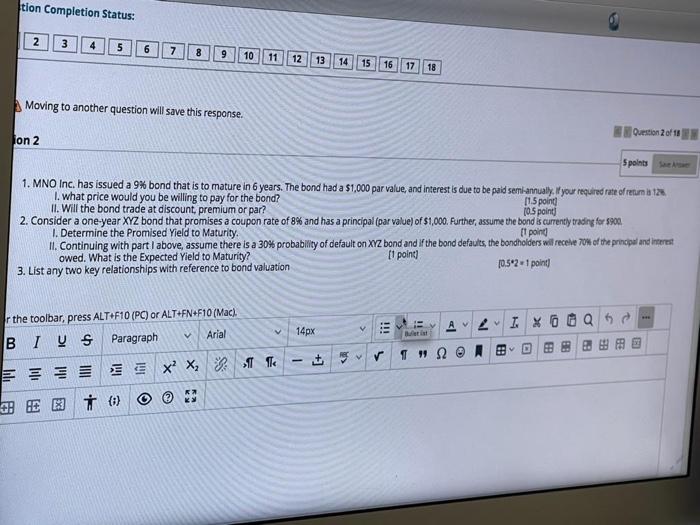

tion Completion Status: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Moving to another question will save this response. Ouestion 2018 Ion 2 Spoints 1. MNO Inc. has issued a 9% bond that is to mature in 6 years. The band had a $1,000 par value, and interest is due to be paid semiannually. If your required rate of return in 12 1. what price would you be willing to pay for the bond? 11.5 point II. Will the bond trade at discount, premium or par? 10.5 point 2. Consider a one-year XYZ bond that promises a coupon rate of 8% and has a principal (par value) of $1,000. Further, assume the bond is currently trading for 5900 1. Determine the Promised Yield to Maturity. II. Continuing with part I above, assume there is a 30% probability of default on XYZ bond and if the bond defaults, the bondholders will receive 70 of the principal and interest owed. What is the expected Yield to Maturity? [t point) 10.5* 21 point) 3. List any two key relationships with reference to bond valuation r the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I YS Paragraph Arial LIXO Q6 v 14px st FR 1992 x? X2 - Te E E E * (1) O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts