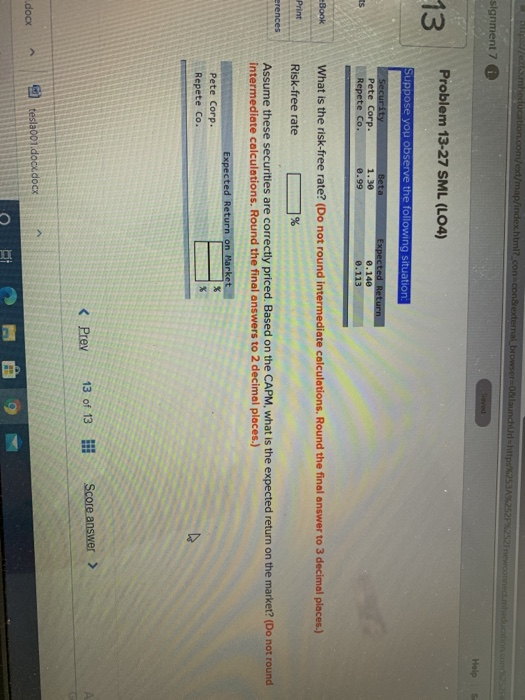

Question: tion.com/ext/map/indexhtml?con consederal browser OlaunchUd=http%253A%252F%252Fwconnecumdu.com signment 7 vod Help Problem 13-27 SML (LO4) 13 Suppose you observe the following situation Beta Security Pete Corp. Repete Co.

tion.com/ext/map/indexhtml?con consederal browser OlaunchUd=http%253A%252F%252Fwconnecumdu.com signment 7 vod Help Problem 13-27 SML (LO4) 13 Suppose you observe the following situation Beta Security Pete Corp. Repete Co. Expected Return 0.140 8.113 1.30 0.99 ts Book What is the risk-free rate? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) Risk-free rate % Print erences Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Pete Corp. Repete Co. Expected Return on Market % % Score answer > 13 of 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts