Question: Tips: Economic evaluation > Example [Reference 1] Unit-of-production amortization Assuming total capitalized costs at the end of the period are equal to $1 500 000,

![Tips: Economic evaluation > Example [Reference 1] Unit-of-production amortization Assuming total](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66efd0e4b220a_61266efd0e443179.jpg)

Tips:

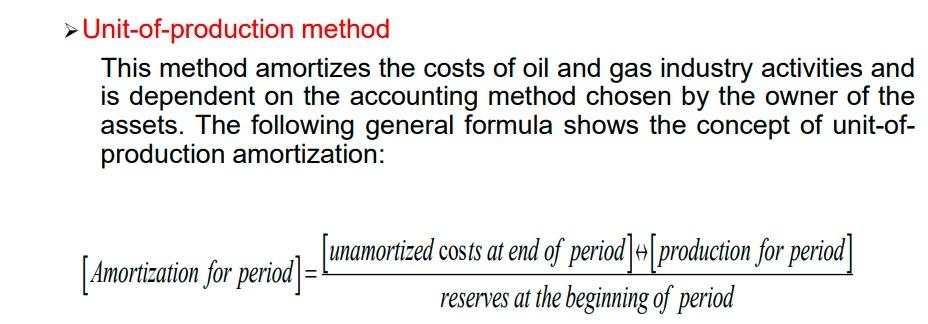

Economic evaluation > Example [Reference 1] Unit-of-production amortization Assuming total capitalized costs at the end of the period are equal to $1 500 000, accumulated amortization taken in prior periods is equal to $500 000, estimated remaining recoverable reserves at the end of the period are equal to 440 000 BOE, and production during the period is equal to 60 000 BOE, calculate the amortization for the period using the unit-of-production method. > Unit-of-production method This method amortizes the costs of oil and gas industry activities and is dependent on the accounting method chosen by the owner of the assets. The following general formula shows the concept of unit-of- production amortization: unamortized costs at end of period)"[production for period] [Amortization for period] = reserves at the beginning of period Economic evaluation > Example [Reference 1] Unit-of-production amortization Assuming total capitalized costs at the end of the period are equal to $1 500 000, accumulated amortization taken in prior periods is equal to $500 000, estimated remaining recoverable reserves at the end of the period are equal to 440 000 BOE, and production during the period is equal to 60 000 BOE, calculate the amortization for the period using the unit-of-production method. > Unit-of-production method This method amortizes the costs of oil and gas industry activities and is dependent on the accounting method chosen by the owner of the assets. The following general formula shows the concept of unit-of- production amortization: unamortized costs at end of period)"[production for period] [Amortization for period] = reserves at the beginning of period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts