Question: Title: Financial Markets Question points An individual has utility function Urbin(C) where b is a parameter, C is consumption. The individual is choosing consumption over

Title: Financial Markets Question

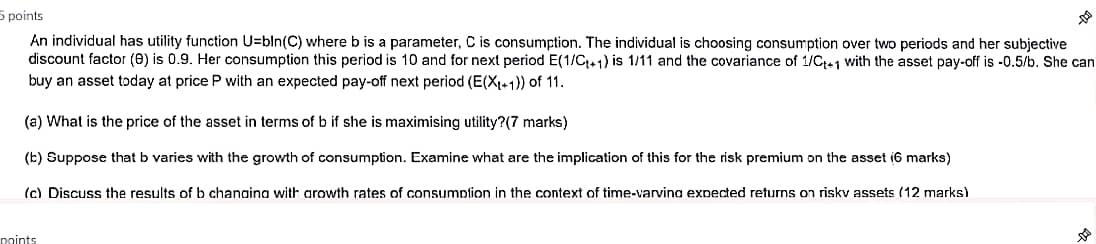

points An individual has utility function Urbin(C) where b is a parameter, C is consumption. The individual is choosing consumption over two periods and her subjective discount factor (0) is 0.9. Her consumption this period is 10 and for next period E(1/C++) is 1/11 and the covariance of 1/C++1 with the asset pay-off is -0.5/b. She can buy an asset today at price P with an expected pay-off next period (E(Xx+1)) of 11. (a) What is the price of the asset in terms of b if she is maximising utility? (7 marks) (6) Suppose that b varies with the growth of consumption. Examine what are the implication of this for the risk premium on the asset 16 marks) (c) Discuss the results of b changing with arowth rates of consumption in the context of time-varving expected returns on riskv assets (12 marks) naints points An individual has utility function Urbin(C) where b is a parameter, C is consumption. The individual is choosing consumption over two periods and her subjective discount factor (0) is 0.9. Her consumption this period is 10 and for next period E(1/C++) is 1/11 and the covariance of 1/C++1 with the asset pay-off is -0.5/b. She can buy an asset today at price P with an expected pay-off next period (E(Xx+1)) of 11. (a) What is the price of the asset in terms of b if she is maximising utility? (7 marks) (6) Suppose that b varies with the growth of consumption. Examine what are the implication of this for the risk premium on the asset 16 marks) (c) Discuss the results of b changing with arowth rates of consumption in the context of time-varving expected returns on riskv assets (12 marks) naints

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts