Question: To access text click this will only work! 1 pts Question 14 Saquon Barkley, Corp.currently produces two different footballs. They are either Regular or Special

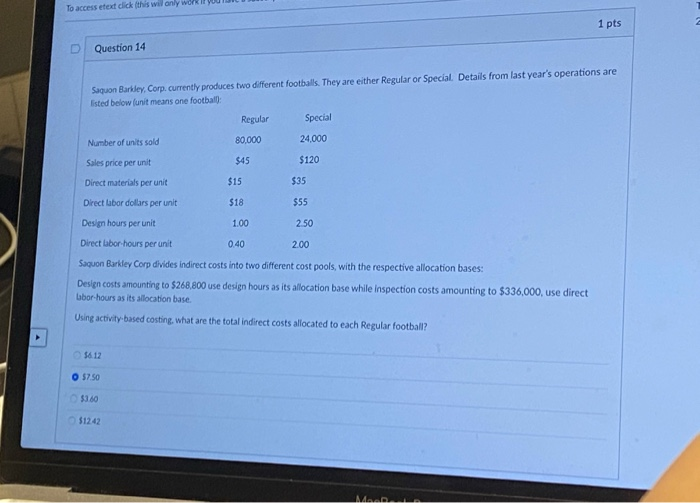

To access text click this will only work! 1 pts Question 14 Saquon Barkley, Corp.currently produces two different footballs. They are either Regular or Special Details from last year's operations are listed below (unit means one football: Regular Special 24,000 Number of units sold 80,000 $45 $120 Sales price per unit Direct materials per unit $15 $35 Direct labor dollars per unit $18 $55 Design hours per unit 1.00 2.50 Direct labor hours per unit 0.40 2.00 Saquon Barkley Corp divides indirect costs into two different cost pools, with the respective allocation bases: Design costs amounting to $268,800 use design hours as its allocation base while inspection costs amounting to $336,000, use direct lbor-hours as its allocation base. Using activity based costing. what are the total indirect costs allocated to each Regular football? 5612 57.50 $360 $1242 M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts