Question: to another question S4,35 seconds Question 1 stion Completion Status: On August 1, 2019, Microsoft Company purchased a new machine for 5330,000. The machine is

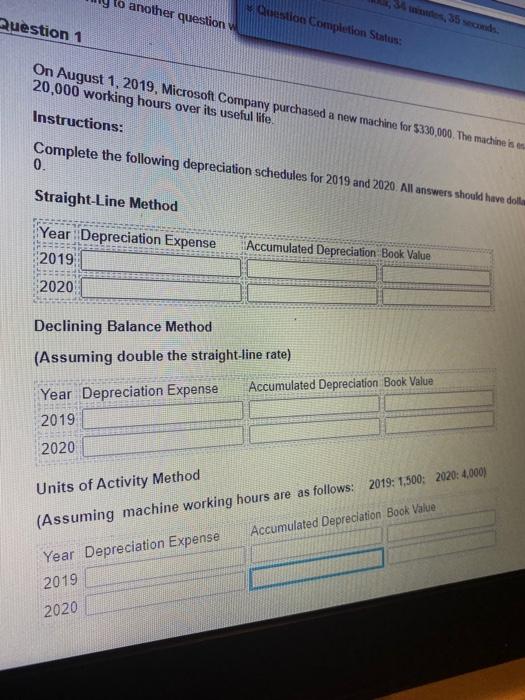

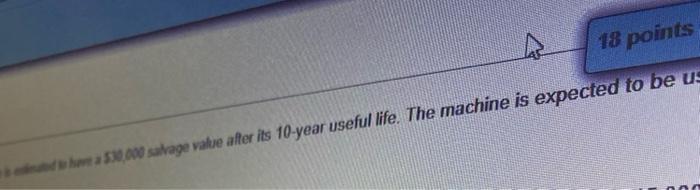

to another question S4,35 seconds Question 1 stion Completion Status: On August 1, 2019, Microsoft Company purchased a new machine for 5330,000. The machine is 20,000 working hours over its useful life Instructions: Complete the following depreciation schedules for 2019 and 2020. All answers should have doll 0. Straight-Line Method Year Depreciation Expense 2019 Accumulated Depreciation Book Value 2020 Declining Balance Method (Assuming double the straight-line rate) Accumulated Depreciation Book Value Year Depreciation Expense 2019 2020 Units of Activity Method (Assuming machine working hours are as follows: 2019: 1,500; 2020: 4,000) Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020 Status cos response. nased a new machine for $330,000. The machine is estimated to have a 53000 s for 2019 and 2020. All answers should have dollar signs and commes. Forum ed Depreciation Book Value ted Depreciation Book Value 2019: 1.500; 2020: 4,000) Value 18 points whowaw.000 sabrage valse after its 10-year useful life. The machine is expected to be us

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts