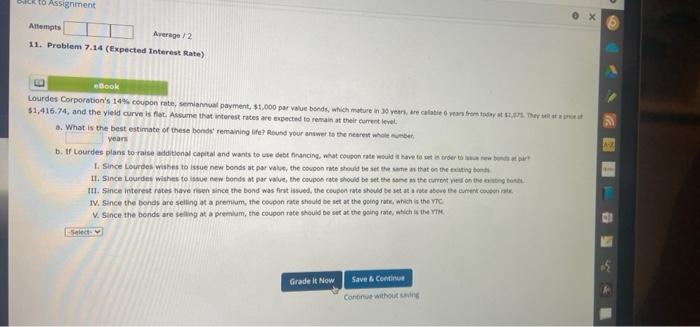

Question: to Assignment 0 x Attempts Average 2 11. Problem 7.14 (Expected Interest Rate) eBook Lourdes Corporation's 14% coupon rate, semiannual payment. $1.000 par value bonds,

to Assignment 0 x Attempts Average 2 11. Problem 7.14 (Expected Interest Rate) eBook Lourdes Corporation's 14% coupon rate, semiannual payment. $1.000 par value bonds, which mature 3 years, are clear the $1,416.74, and the yield curveis fot. Assume that interest rates are expected to remain their current a. What is the best estimate of these bonds remaining life? Round your answer to the new years b. If Lourdes plans to raise additional capital and wants to use debt financing, what coupon at would have to set is crder town 1. Since Lourdes wishes to issue new bonds at per valve, the counter themes that on the one II. Since Lourdes wishes to sew bonds at par value the coupon rate should be the same as the current in the III. Since interest rates have risen since the bond was first issued, the coupon rate should be set starte above the current con IV. Since the bonds are selling at a premium, the coupon rate should be set at the points, which is the YC Since the bonds are selling at a premium, the coupon rate should be set at the going rate, which is the YTM Select Grade it Now Save & Continue Continut without

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts