Question: To be submitted in excel: Please show steps as I must submit this problem in excel. Thank you! 7. Layne Resources, Inc., has a $1,000

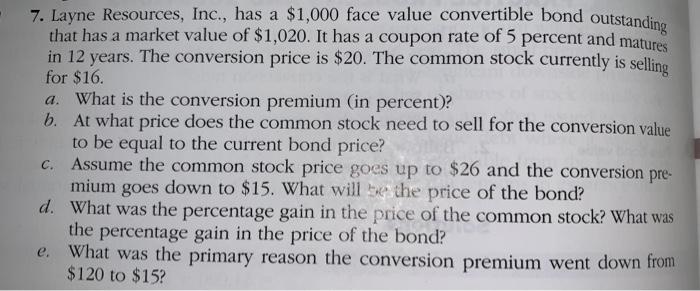

7. Layne Resources, Inc., has a $1,000 face value convertible bond outstanding that has a market value of $1,020. It has a coupon rate of 5 percent and matures in 12 years. The conversion price is $20. The common stock currently is selling for $16. a. What is the conversion premium (in percent)? b. At what price does the common stock need to sell for the conversion value to be equal to the current bond price? c. Assume the common stock price goes up to $26 and the conversion pre- mium goes down to $15. What will the price of the bond? d. What was the percentage gain in the price of the common stock? What was the percentage gain in the price of the bond? e. What was the primary reason the conversion premium went down from $120 to $15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts