Question: To begin identifying Jake's options in reference to his goals answer the following questions: 1. Analyze Jake's eash flow statement. a. Calculate his net worth,

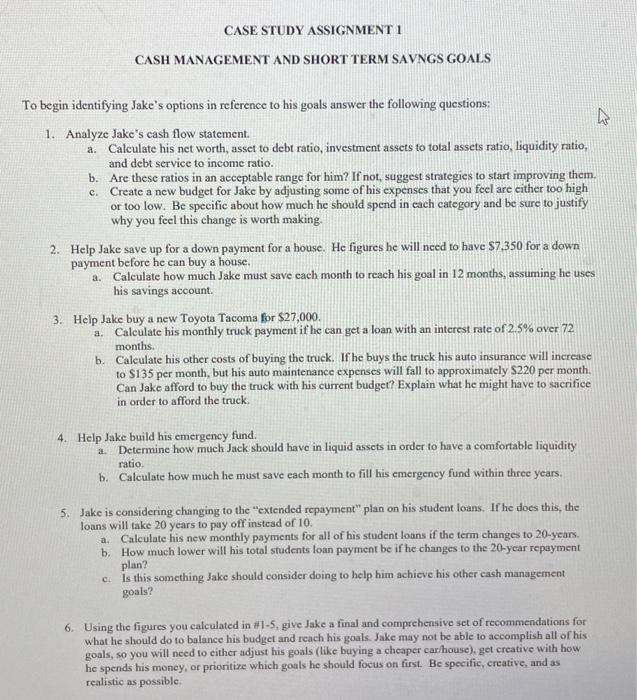

To begin identifying Jake's options in reference to his goals answer the following questions: 1. Analyze Jake's eash flow statement. a. Calculate his net worth, asset to debt ratio, investment assets to total assets ratio, liquidity ratio, and debt service to income ratio. b. Are these ratios in an acceptable range for him? If not, suggest strategies to start improving them. c. Create a new budget for Jake by adjusting some of his expenses that you feel are either too high or too low. Be specific about how much he should spend in each category and be sure to justify why you feel this change is worth making. 2. Help Jake save up for a down payment for a house. He figures he will need to have $7,350 for a down payment before he can buy a house. a. Calculate how much Jake must save cach month to reach his goal in 12 months, assuming he uses his savings account. 3. Help Jake buy a new Toyota Tacoma for $27,000. a. Caleulate his monthly truck payment if he can get a loan with an interest rate of 2.5% over 72 months. b. Calculate his other costs of buying the truck. If he buys the truck his auto insurance will increase to $135 per month, but his auto maintenance expenses will fall to approximately $220 per month. Can Jake afford to buy the truck with his current budget? Explain what he might have to sacrifice in order to afford the truck. 4. Help Jake build his emergency fund: a. Determine how much Jack should have in liquid assets in order to have a comfortable liquidity ratio. b. Calculate how much he must save each month to fill his emergency fund within three years. 5. Jake is considering changing to the "extended repayment" plan on his student loans, If he does this, the loans will take 20 years to pay off instead of 10. a. Calculate his new monthly payments for all of his student loans if the term changes to 20-years. b. How much lower will his total students loan payment be if he changes to the 20-year repayment plan? c. Is this something Jake should consider doing to help him achieve his other eash management goals? 6. Using the figures you calculated in #15, give Jake a final and comprehensive set of recommendations for what he should do to balance his budget and reach his goals. Jake may not be able to accomplish all of his goals, so you will need to either adjust his goals (like buying a cheaper car/house), get creative with how he spends his money, or prioritize which goals he should focus on first. Be specific, ereative, and as realistic as possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts