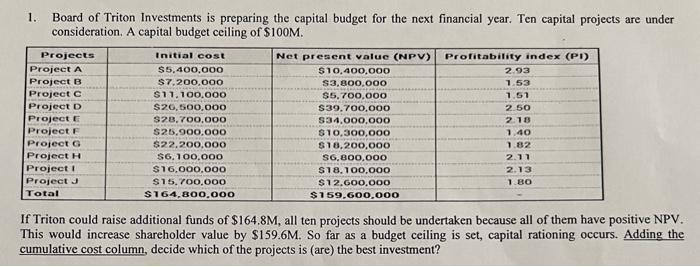

Question: 1. Board of Triton Investments is preparing the capital budget for the next financial year. Ten capital projects are under consideration. A capital budget

1. Board of Triton Investments is preparing the capital budget for the next financial year. Ten capital projects are under consideration. A capital budget ceiling of $100M. Net present value (NPV) Profitability index (PI) Projects Project A Project B Project C Project D Project E Project F Project G Project H Project I Project J Total Initial cost $5,400,000 $7,200,000 $11,100,000 $20,500,000 $28,700,000 $25,900,000 $22,200,000 $6,100,000 $16,000,000 $15,700,000 $164,800,000 $10,400,000 $3,800,000 $5,700,000 $39.700,000 $34,000,000 $10,300,000 $18,200,000 S6,800,000 $18,100,000 $12,600,000 $159,600,000 2.93 1.53 1.51 2.50 2.18 1.40 1.82 2.11 2.13 1.80 If Triton could raise additional funds of $164.8M, all ten projects should be undertaken because all of them have positive NPV. This would increase shareholder value by $159.6M. So far as a budget ceiling is set, capital rationing occurs. Adding the cumulative cost column, decide which of the projects is (are) the best investment?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Project Initial Cost 000 Cumulative cost 000 NPV 000 A 5400 5400 10400 B 7200 12600 3800 ... View full answer

Get step-by-step solutions from verified subject matter experts