Question: To carry out the pilot program, you need to contact new suppliers and it is possible that the cost of the pilot program may be

- To carry out the pilot program, you need to contact new suppliers and it is possible that the cost of the pilot program may be higher than expected. Please do a break-even analysis for your NPV calculation in Part i, in which the key parameter is the cost of the pilot program. Discuss how you should use the result of this break-even analysis in your decision making.

[8 marks]

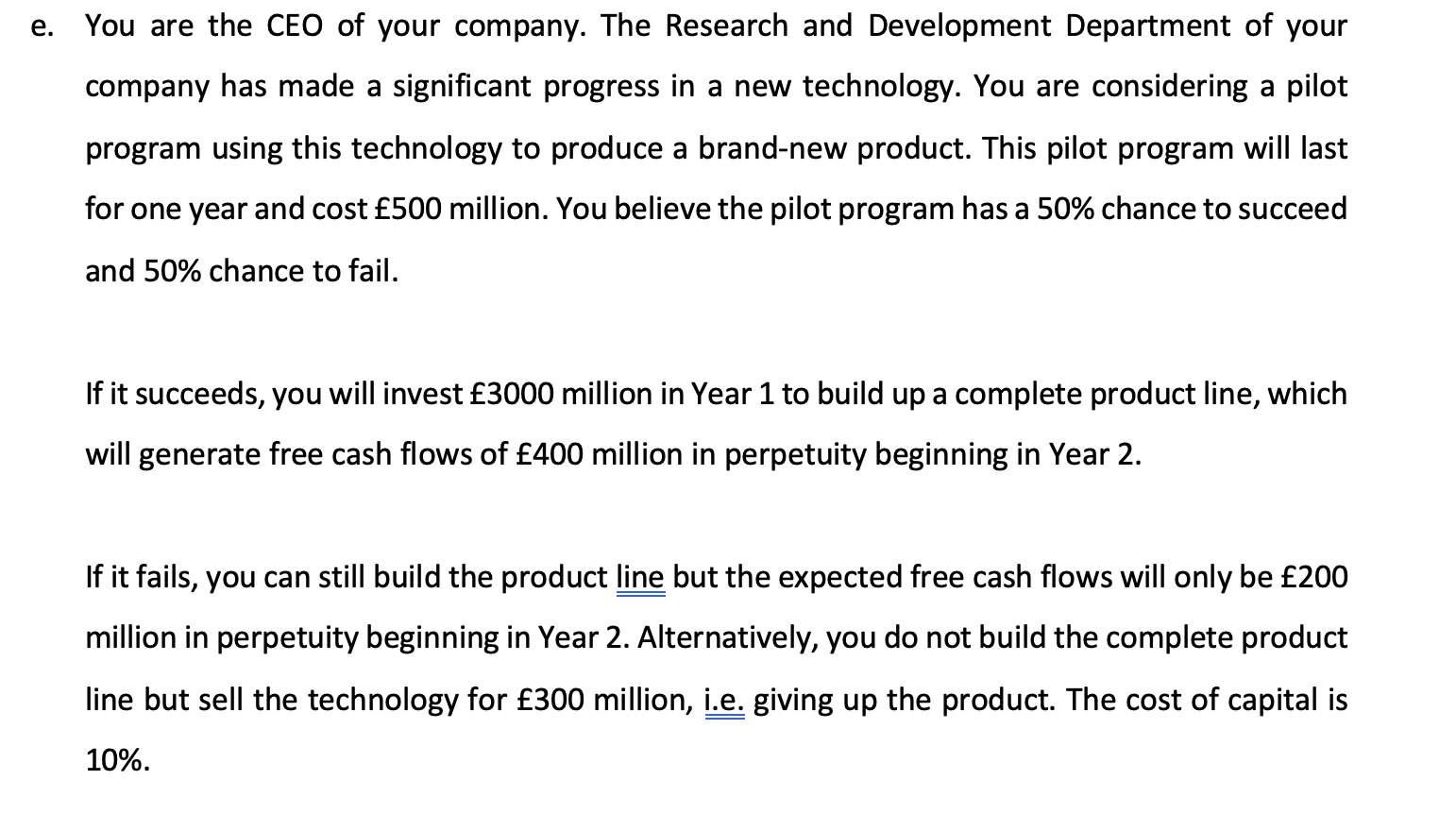

e. You are the CEO of your company. The Research and Development Department of your company has made a significant progress in a new technology. You are considering a pilot program using this technology to produce a brand-new product. This pilot program will last for one year and cost 500 million. You believe the pilot program has a 50% chance to succeed and 50% chance to fail. If it succeeds, you will invest 3000 million in Year 1 to build up a complete product line, which will generate free cash flows of 400 million in perpetuity beginning in Year 2. If it fails, you can still build the product line but the expected free cash flows will only be 200 million in perpetuity beginning in Year 2. Alternatively, you do not build the complete product line but sell the technology for 300 million, i.e. giving up the product. The cost of capital is 10%. e. You are the CEO of your company. The Research and Development Department of your company has made a significant progress in a new technology. You are considering a pilot program using this technology to produce a brand-new product. This pilot program will last for one year and cost 500 million. You believe the pilot program has a 50% chance to succeed and 50% chance to fail. If it succeeds, you will invest 3000 million in Year 1 to build up a complete product line, which will generate free cash flows of 400 million in perpetuity beginning in Year 2. If it fails, you can still build the product line but the expected free cash flows will only be 200 million in perpetuity beginning in Year 2. Alternatively, you do not build the complete product line but sell the technology for 300 million, i.e. giving up the product. The cost of capital is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts