Question: To conduct this manufacturing they import certain electronic components from countries like Japan and South Korea. The market for the manufactured tools are the U.S.A,

To conduct this manufacturing they import certain electronic components from countries like Japan and South Korea.

The market for the manufactured tools are the U.S.A, Australia, Canada and United Kingdom (U.K). However, the majority of sales is in the U.K. Therefore, the company has already put up a subsidiary in the U.K. It resells and distribute the products to different businesses. The quarterly net profit after tax generated by the subsidiary is £500,000. The exports to Canada and Australia are to other independent distributing companies that buys the tools at wholesale prices from HighTech.

HighTech is also considering the construction of an electronic component manufacturing plant in the U.S.A. to eliminate the risks and costs associated with the current importing of electronic components from countries like Japan and South Korea.

HighTech already has sufficient manufacturing space available and only has to import manufacturing equipment of 63,000,000 Yen from Japan. The installation of the machinery will be conducted by local U.S.A. companies and will cost $1,000,000.

The Chief Executive O

fficer (CEO) of HighTech, requests the following information to assist him with determining the extent of exchange rate risk and the availability of funds to conduct the multinational transactions:

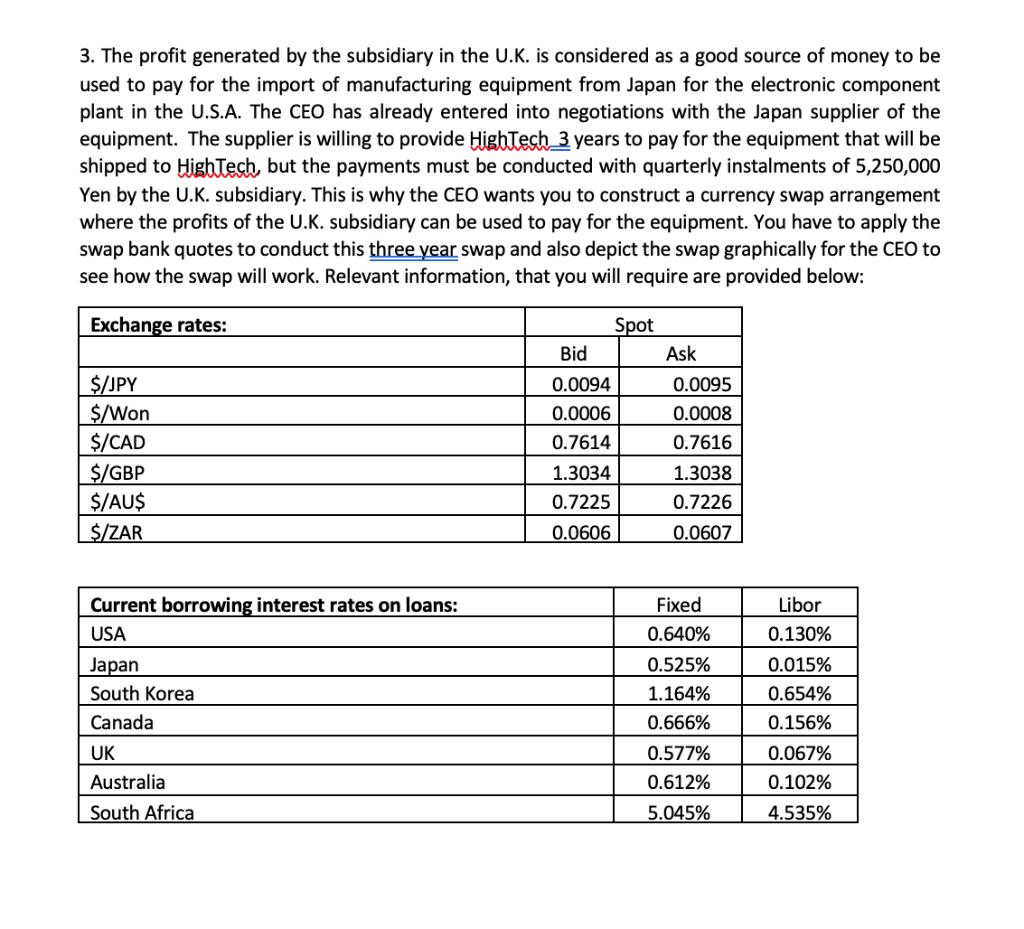

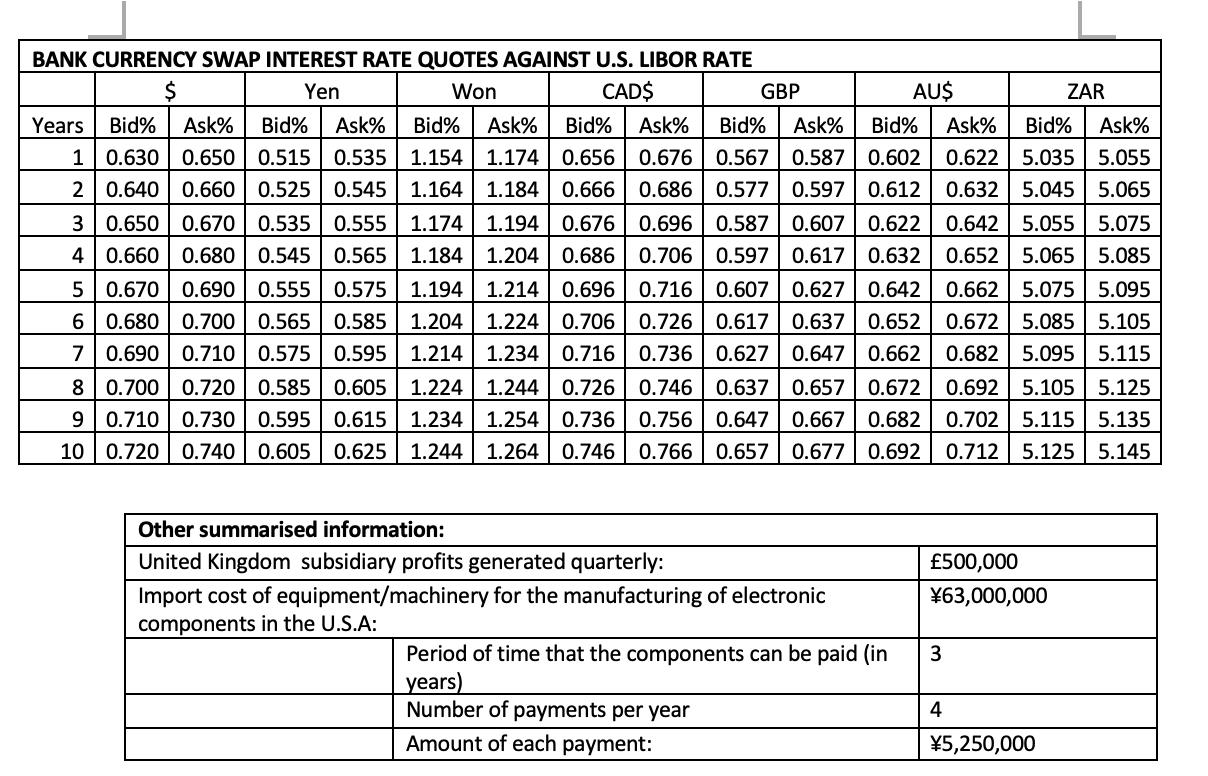

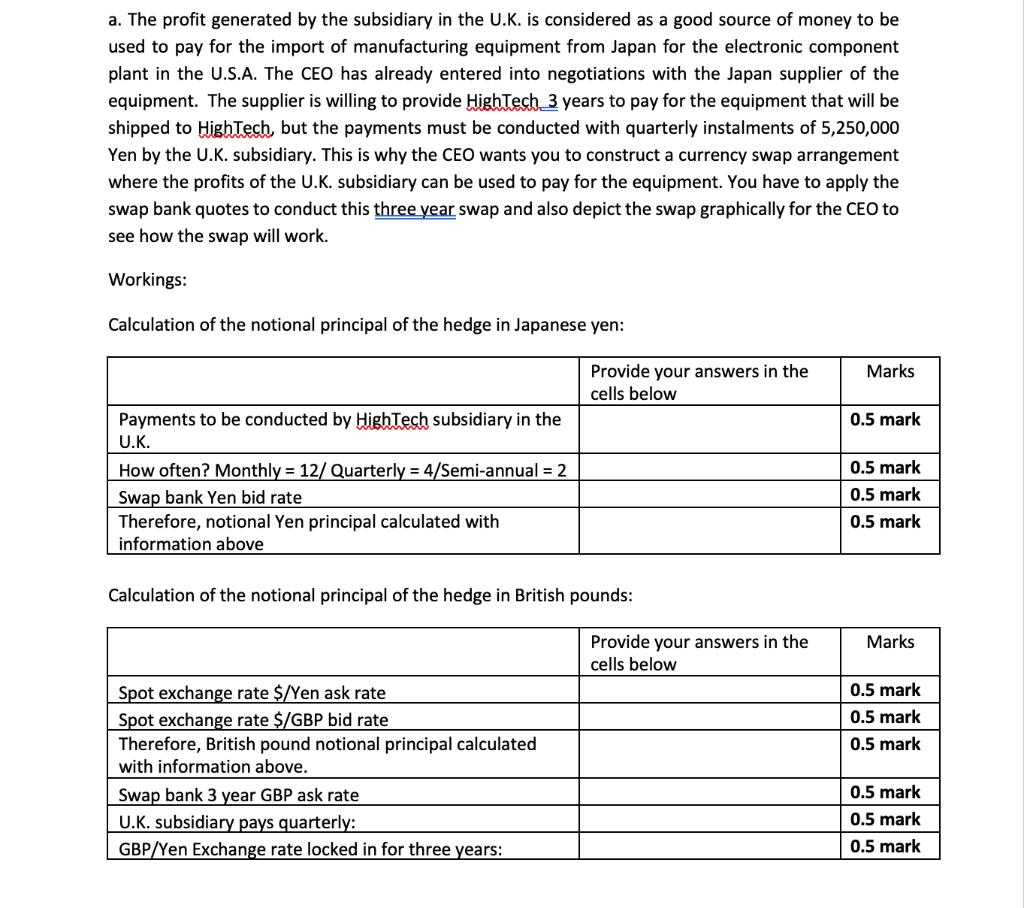

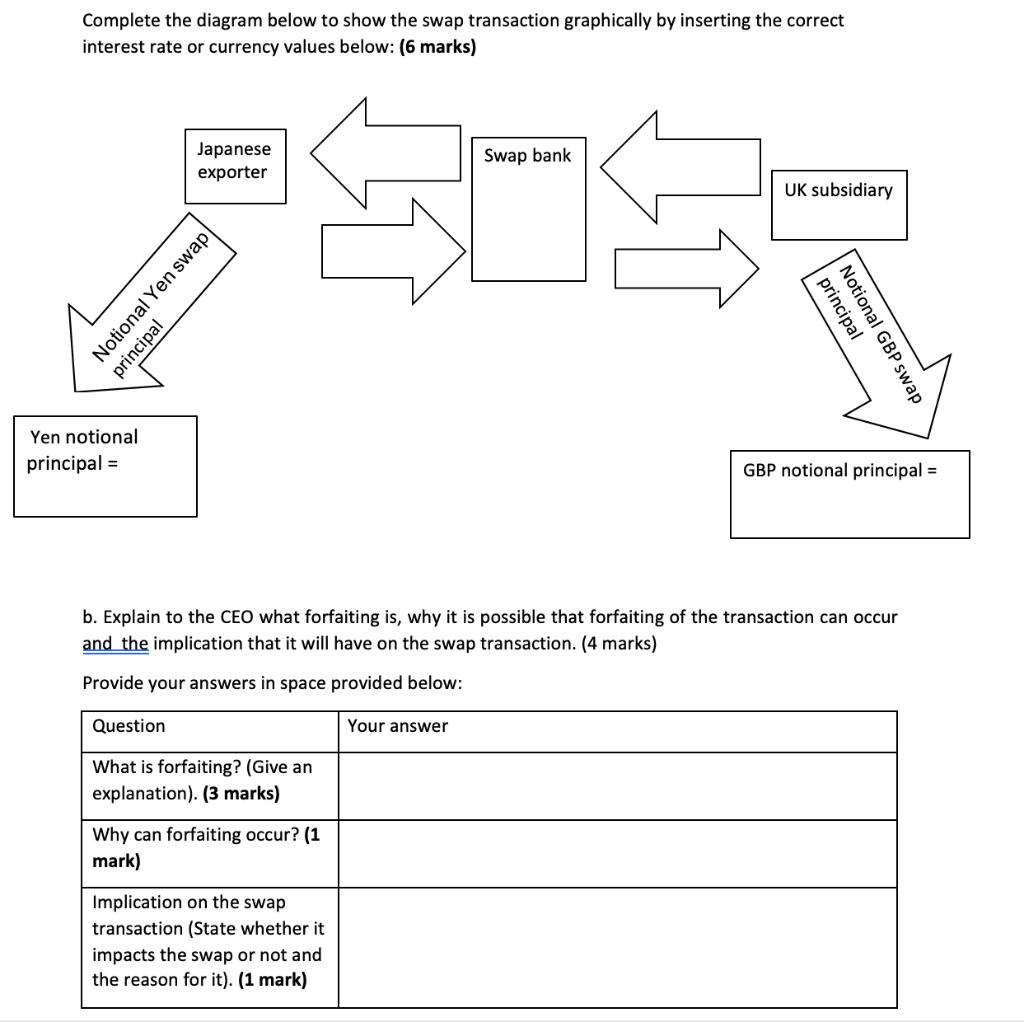

3. The profit generated by the subsidiary in the U.K. is considered as a good source of money to be used to pay for the import of manufacturing equipment from Japan for the electronic component plant in the U.S.A. The CEO has already entered into negotiations with the Japan supplier of the equipment. The supplier is willing to provide HighTech 3 years to pay for the equipment that will be shipped to HighTech, but the payments must be conducted with quarterly instalments of 5,250,000 Yen by the U.K. subsidiary. This is why the CEO wants you to construct a currency swap arrangement where the profits of the U.K. subsidiary can be used to pay for the equipment. You have to apply the swap bank quotes to conduct this three year swap and also depict the swap graphically for the CEO to see how the swap will work. Relevant information, that you will require are provided below: Exchange rates: $/JPY $/Won $/CAD $/GBP $/AU$ $/ZAR Current borrowing interest rates on loans: USA Japan South Korea Canada UK Australia South Africa Spot Bid Ask 0.0094 0.0095 0.0006 0.0008 0.7614 0.7616 1.3034 1.3038 0.7225 0.7226 0.0606 0.0607 Fixed Libor 0.640% 0.130% 0.525% 0.015% 1.164% 0.654% 0.666% 0.156% 0.577% 0.067% 0.612% 0.102% 5.045% 4.535%

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

a Calculation of the notional principal of the hedge in Japanese yen Payments to be conducted by High Tech subsidiary in the UK Quarterly 4 Swap bank ... View full answer

Get step-by-step solutions from verified subject matter experts