Question: To develop the project, you will select the financial statements of American Airline using the EDGAR database (http://www.sec.gov/edgar.shtml). You will use the FASB coding system

To develop the project, you will select the financial statements of American Airline using the EDGAR database (http://www.sec.gov/edgar.shtml). You will use the FASB coding system to research proposed accounting standards for the current year or for the previous year (liabilities and capital - only those referring to transactions). Then you will create financial accounting information, through Excel, where the proposed standards are applied, FASB, in the company you have chosen. REQUIRED: Using the American Airline 10K Report for the year ending December 31, 2021 (Annual Report 2021), answer questions 1 through 3. Question 4 provides the document you need to review. Look in the 10K for the leases note and summarize in your own words the impact the leases had on the company's Balance Sheet. Avoid merely copying and translating the note. Your explanation must show that you understand what you read and can explain it. Synthesize and not merely copy and paste. 1. Look in the 10K for Income Taxes and summarize in your own words the impact the deferred tax accounts had on the company's Balance Sheet. Avoid merely copying and translating the note. Your explanation must show that you understand what you read and can explain it. Synthesize and not merely copy and paste. 2. Information on the Balance Sheet possibly mixes lease debt with other long-term debt. This makes analysis difficult. Using the information provided in the lease note, prepare a vertical and horizontal analysis of the debt (liability) by lease. For vertical analysis you need the total assets of the company reported on the balance sheet. Comment on the results. 3. Using the information provided in the income tax note, prepare a vertical and horizontal analysis of the balances of (1) Total deferred tax assets, (2) Total deferred tax liabilities, and (3) Net deferred tax liability or Net Total deferred tax Asset. For vertical analysis you need the total assets of the company reported on the balance sheet. Comment on the results. 4. Review the document at the end of this instruction (everyone uses the same document for this question) where the data on the American Airlines Group Inc pension note is presented. Summarize in your own words what amounts and accounts American owes disclose in the (1) Balance Sheet and in the (2) Income Statement related to your Pension Plan (Pension benefits). Avoid merely copying and translating the note. Your explanation must show that you understand what you read and can explain it. Synthesize and not merely copy and paste.

Check attached sample and show the work in excel, including reference

Below is a sample of what they ask me

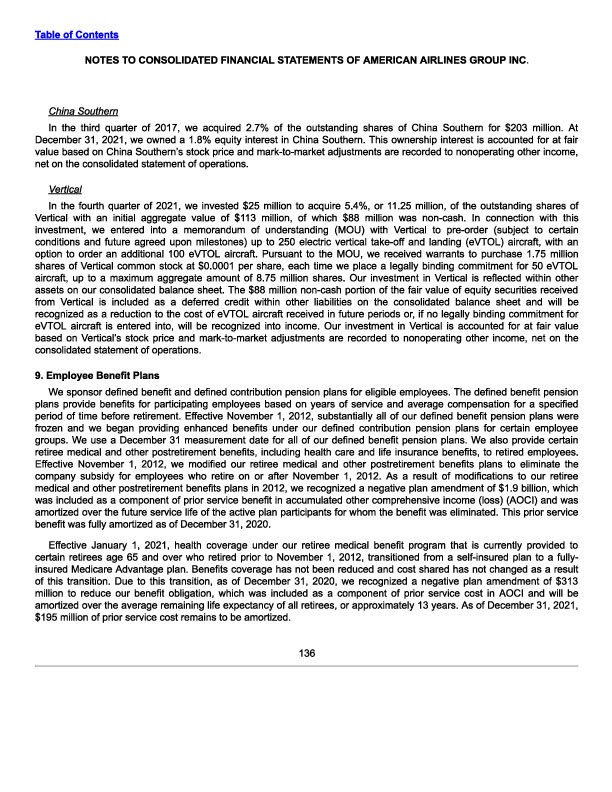

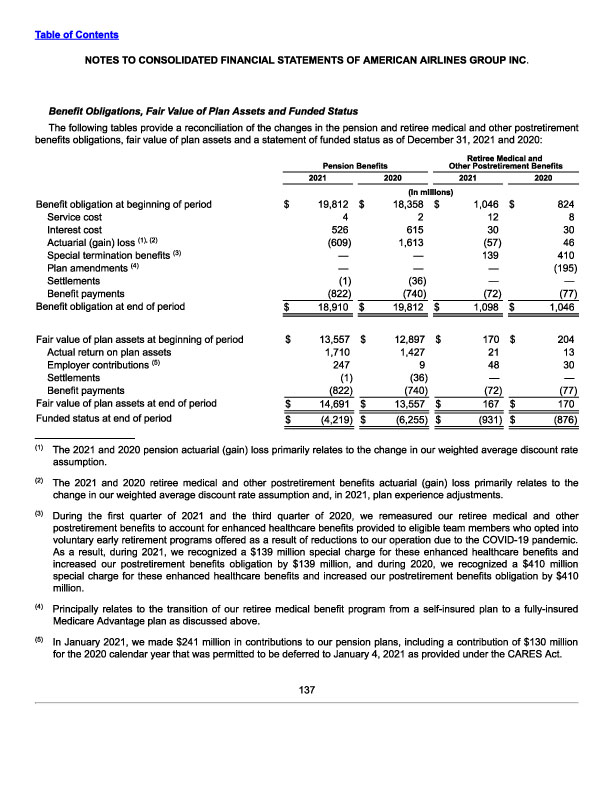

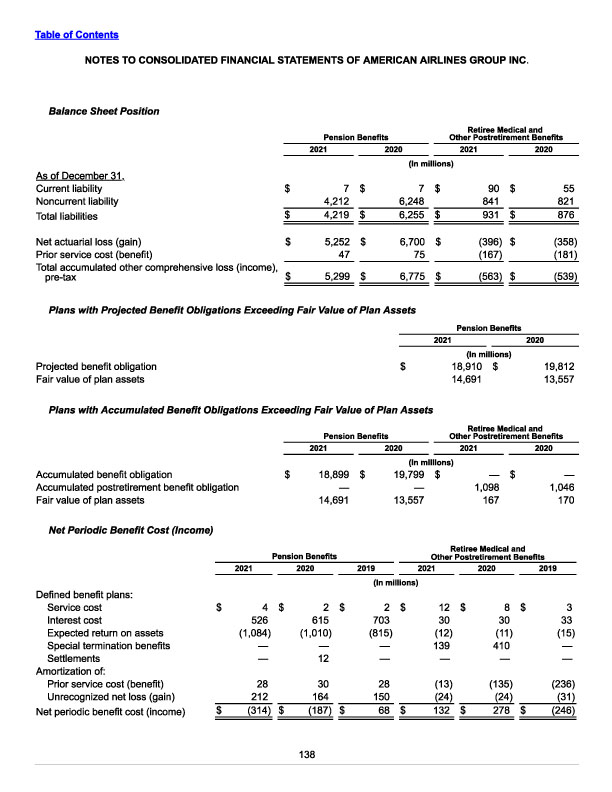

Table of Contents NOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC. China Southern In the third quarter of 2017, we acquired 2.7% of the outstanding shares of China Southern for $203 million. At December 31, 2021, we owned a 1.8% equity interest in China Southern. This ownership interest is accounted for at fair value based on China Southern's stock price and mark-to-market adjustments are recorded to nonoperating other income, net on the consolidated statement of operations. Vertical In the fourth quarter of 2021, we invested $25 million to acquire 5.4%, or 11.25 million, of the outstanding shares of Vertical with an initial aggregate value of $113 million, of which $88 million was non-cash. In connection with this investment, we entered into a memorandum of understanding (MOU) with Vertical to pre-order (subject to certain conditions and future agreed upon milestones) up to 250 electric vertical take-off and landing (eVTOL) aircraft, with an option to order an additional 100 evTOL aircraft. Pursuant to the MOU, we received warrants to purchase 1.75 million shares of Vertical common stock at $0.0001 per share, each time we place a legally binding commitment for 50 evTOL aircraft, up to a maximum aggregate amount of 8.75 million shares. Our investment in Vertical is reflected within other assets on our consolidated balance sheet. The $88 million non-cash portion of the fair value of equity securities received from Vertical is included as a deferred credit within other liabilities on the consolidated balance sheet and will be recognized as a reduction to the cost of evTOL aircraft received in future periods or, if no legally binding commitment for EVTOL aircraft is entered into, will be recognized into income. Our investment in Vertical is accounted for at fair value based on Vertical's stock price and mark-to-market adjustments are recorded to nonoperating other income, net on the consolidated statement of operations. 9. Employee Benefit Plans We sponsor defined benefit and defined contribution pension plans for eligible employees. The defined benefit pension plans provide benefits for participating employees based on years of service and average compensation for a specified period of time before retirement. Effective November 1, 2012, substantially all of our defined benefit pension plans were frozen and we began providing enhanced benefits under our defined contribution pension plans for certain employee groups. We use a December 31 measurement date for all of our defined benefit pension plans. We also provide certain retiree medical and other postretirement benefits, including health care and life insurance benefits, to retired employees. Effective November 1, 2012, we modified our retiree medical and other postretirement benefits plans to eliminate the company subsidy for employees who retire on or after November 1, 2012. As a result of modifications to our retiree medical and other postretirement benefits plans in 2012, we recognized a negative plan amendment of $1.9 billion, which was included as a component of prior service benefit in accumulated other comprehensive income (loss) (AOCI) and was amortized over the future service life of the active plan participants for whom the benefit was eliminated. This prior service benefit was fully amortized as of December 31, 2020. Effective January 1, 2021, health coverage under our retiree medical benefit program that is currently provided to certain retirees age 65 and over who retired prior to November 1, 2012, transitioned from a self-insured plan to a fully- Insured Medicare Advantage plan. Benefits coverage has not been reduced and cost shared has not changed as a result of this transition. Due to this transition, as of December 31, 2020, we recognized a negative plan amendment of $313 million to reduce our benefit obligation, which was included as a component of prior service cost in AOCI and will be amortized over the average remaining life expectancy of all retirees, or approximately 13 years. As of December 31, 2021. $195 million of prior service cost remains to be amortized. 136Table of Contents NOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC. Benefit Obligations, Fair Value of Plan Assets and Funded Status The following tables provide a reconciliation of the changes in the pension and retiree medical and other postretirement benefits obligations, fair value of plan assets and a statement of funded status as of December 31, 2021 and 2020: Retiree Medical and Pension Benefits Other Postretirement Benefits 2021 2020 2021 2020 (In millions) Benefit obligation at beginning of period $ 19,812 $ 18,358 1,046 S 824 Service cost 2 12 8 Interest cost 526 615 30 30 Actuarial (gain) loss (1) () (609) 1,613 (57) Special termination benefits (3) 139 410 Plan amendments (4) (195) Settlements (1) (36) Benefit payments (822 740 (72) (77) Benefit obligation at end of period 18,910 $ 19,812 098 S 1,046 Fair value of plan assets at beginning of period 13,557 $ 12,897 170 $ 204 Actual return on plan assets 1,710 1,427 21 13 Employer contributions () 247 9 48 30 Settlements (1) (36) Benefit payments (822) (740) (72) (77) Fair value of plan assets at end of period 14,691 3,557 $ 167 $ 170 Funded status at end of period (4,219) (6,255) 931) $ (876) " The 2021 and 2020 pension actuarial (gain) loss primarily relates to the change in our weighted average discount rate assumption. The 2021 and 2020 retiree medical and other postretirement benefits actuarial (gain) loss primarily relates to the change in our weighted average discount rate assumption and, in 2021, plan experience adjustments. " During the first quarter of 2021 and the third quarter of 2020, we remeasured our retiree medical and other postretirement benefits to account for enhanced healthcare benefits provided to eligible team members who opted into voluntary early retirement programs offered as a result of reductions to our operation due to the COVID-19 pandemic. As a result, during 2021, we recognized a $139 million special charge for these enhanced healthcare benefits and increased our postretirement benefits obligation by $139 million, and during 2020, we recognized a $410 million special charge for these enhanced healthcare benefits and increased our postretirement benefits obligation by $410 million. " Principally relates to the transition of our retiree medical benefit program from a self-insured plan to a fully-insured Medicare Advantage plan as discussed above, (In January 2021, we made $241 million in contributions to our pension plans, including a contribution of $130 million for the 2020 calendar year that was permitted to be deferred to January 4, 2021 as provided under the CARES Act. 137Table of Contents NOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC. Balance Sheet Position Retiree Medical and Pension Benefits Other Postretirement Benefits 2021 2020 2021 2020 (In millions As of December 31. Current liability $ 7 $ 90 55 Noncurrent liability 4.212 6.248 841 821 Total liabilities 4.219 ,255 931 876 Net actuarial loss (gain) S 5,252 $ 6,700 (396) $ (358) Prior service cost (benefit) 47 75 (167] (181) Total accumulated other comprehensive loss (income), pre-tax 5,299 $ 6,775 $ (563) $ (539) Plans with Projected Benefit Obligations Exceeding Fair Value of Plan Assets Pension Benefits 2021 2020 (In millions) Projected benefit obligation 18,910 $ 19,812 Fair value of plan assets 14,691 13,557 Plans with Accumulated Benefit Obligations Exceeding Fair Value of Plan Assets Retiree Medical and Pension Benefits Other Postretirement Benefits 202 2020 2021 2020 (In millions) Accumulated benefit obligation $ 18,899 $ 19,799 $ Accumulated postretirement benefit obligation 1,098 1,046 Fair value of plan assets 14.691 13,557 167 170 Net Periodic Benefit Cost (Income) Retiree Medical and Pension Benefits Other Postretirement Benefits 2021 2020 2019 2021 2020 2019 (In millions) Defined benefit plans: Service cost 4 2 2 12 8 3 Interest cost 626 615 703 30 30 33 Expected return on assets (1,084) (1,010) (815) (12) (11) 15) Special termination benefits 139 410 Settlements 12 Amortization of. Prior service cost (benefit) 28 30 28 (13) (135) (236) Unrecognized net loss (gain) 212 164 150 (24) (24) (31) Net periodic benefit cost (income) S (314) $ (187) $ 68 S 132 278 (246 138

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts