Question: To DO ( using excel formulas ) a . ( 1 ) On what financial goal does Stanley seem to be focusing? Is it the

To DO using excel formulas

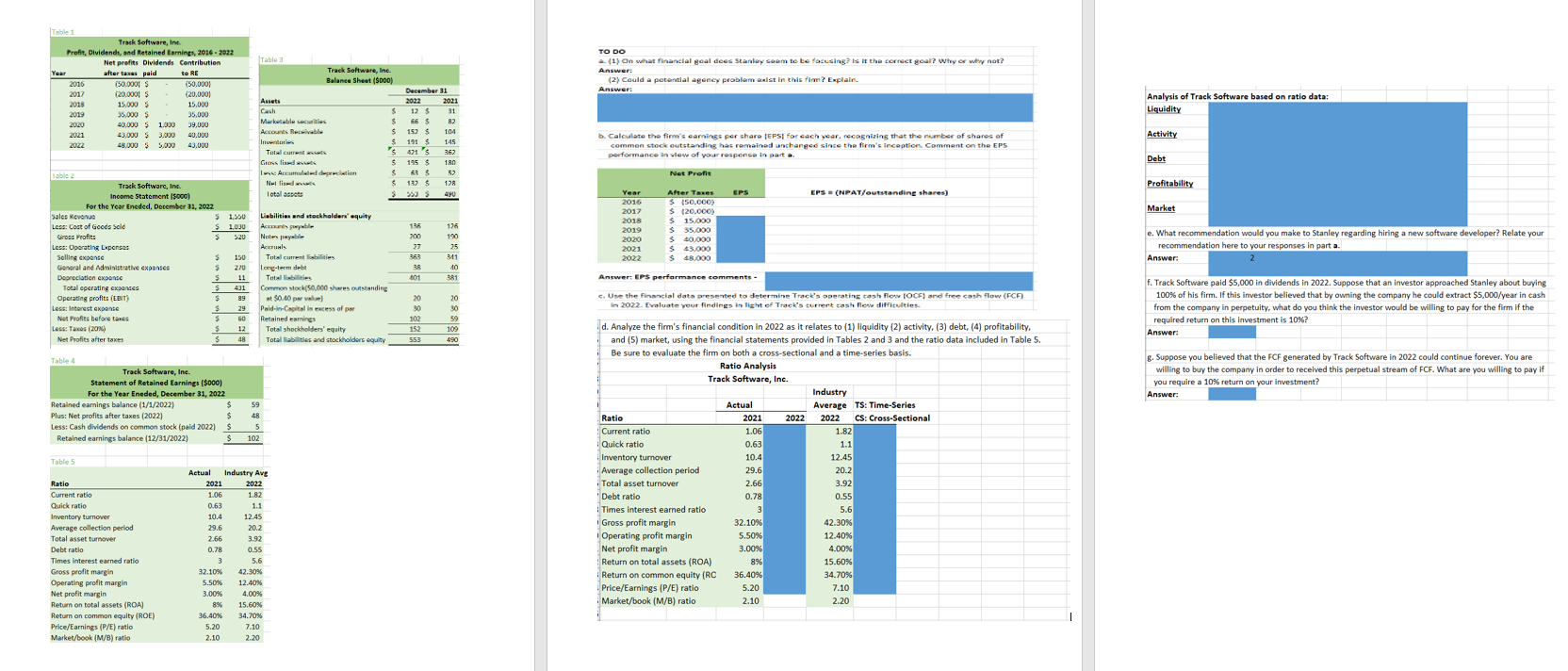

a On what financial goal does Stanley seem to be focusing? Is it the correct goal? Why or why not?

Could a potential agency problem exist in this firm? Explain

b Calculate the firm's earnings per share EPS for each year, recognizing that the number of shares of common stock outstanding has remained unchanged since the firm's inception. Comment on the EPS performance in view of your response in part a

c Use the financial data presented to determine Track's operating cash flow OCF and free cash flow FCF in Evaluate your findings in light of Track's current cash flow difficulties.

d Analyze the firm's financial condition in as it relates to liquidity activity, debt, profitability, and market, using the financial statements provided in Tables and and the ratio data included in Table Be sure to evaluate the firm on both a crosssectional and a timeseries basis.

e What recommendation would you make to Stanley regarding hiring a new software developer? Relate your recommendation here to your responses in part a

f Track Software paid $ in dividends in Suppose that an investor approached Stanley about buying of his firm. If this investor believed that by owning the company he could extract $year in cash from the company in perpetuity, what do you think the investor would be willing to pay for the firm if the required return on this investment is

g Suppose you believed that the FCF generated by Track Software in could continue forever. You are willing to buy the company in order to received this perpetual stream of FCF What are you willing to pay if you require a return on your investment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock