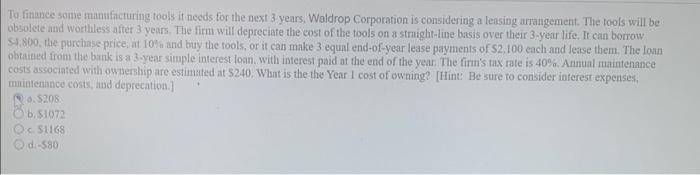

Question: To fitance some mantifacturing tools it needs for the next 3 years. Waldrop Corporation is considering a leasing arrangement. The tools will be obsolete and

To fitance some mantifacturing tools it needs for the next 3 years. Waldrop Corporation is considering a leasing arrangement. The tools will be obsolete and worlhless after 3 years. The firm will depreciate the cost of the tools on a stright-line basis over their 3-year life, Ir can borrow S,800, the purchinse price, at 10 in and bay the tools, or it can make 3 equal end-of-year lease payments of 52,100 each and lease them. The loan obtaied from the bank is a 3-year simple interest loan. with interest paid at the end of the year. The firm's tax rate is 40%. Annual maintenance costs associated with ownership are estimated at 5240 . Wlant is the the Year I cost of owning? [Hint: Be sure fo consider interest expenses, maintenance costs, and deprecation.] 0.5208 b. $1072 c. 51168 d. -580

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts