Question: [To get standard normal distribution Probabilities, go to mathisfun.com then click on Data then scroll all the way down to Standard Normal Distribution Table] Question:

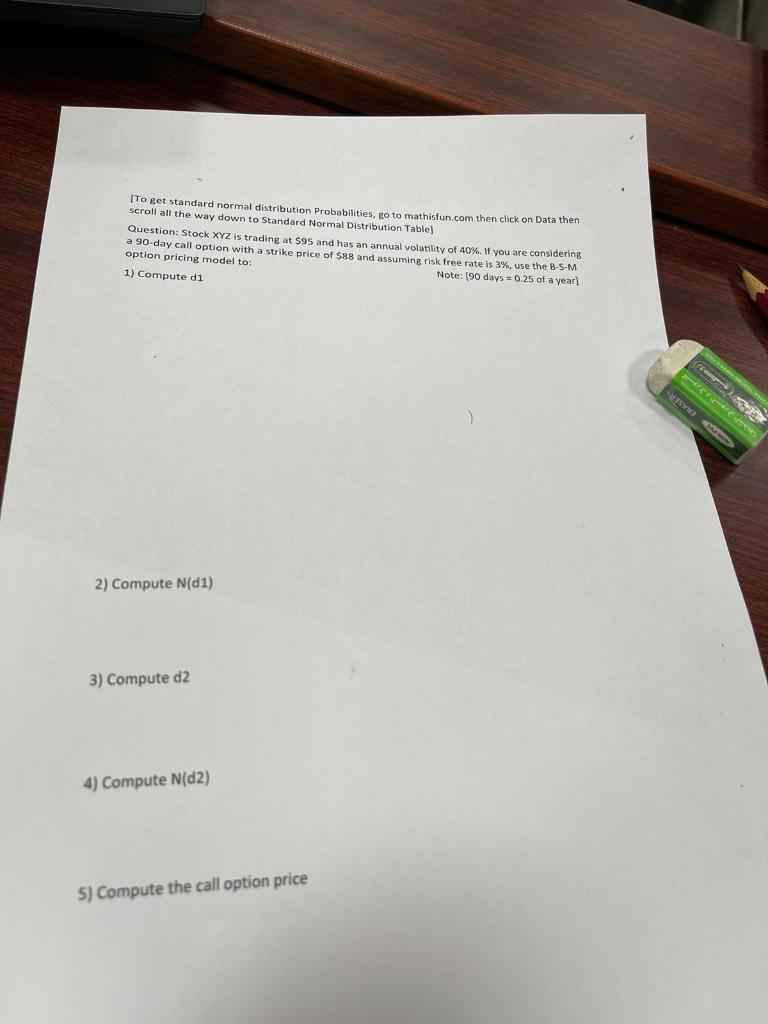

[To get standard normal distribution Probabilities, go to mathisfun.com then click on Data then scroll all the way down to Standard Normal Distribution Table] Question: Stock XYZ is trading at $95 and has an annual volatility of 40%. If you are considering a 90-day call option with a strike price of $88 and assuming risk free rate is 3%, use the B-S-M option pricing model to: 1) Compute di Note: [90 days = 0.25 of a year] 2) Compute N(d1) 3) Compute d2 4) Compute N(d2) 5) Compute the call option price C VETERANO on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts