Question: To keep the calculations simple for this assignment, assume you are single (as in not married). This is probably true for most students anyway. Capital

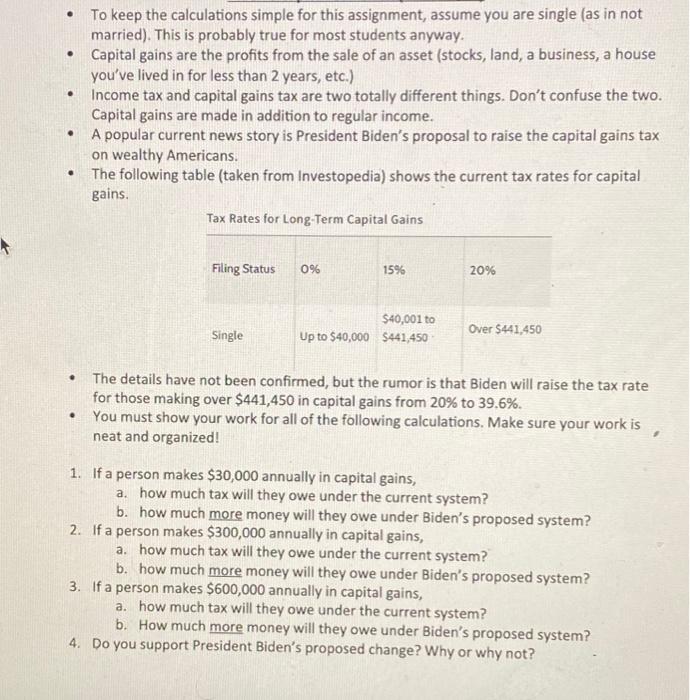

To keep the calculations simple for this assignment, assume you are single (as in not married). This is probably true for most students anyway. Capital gains are the profits from the sale of an asset (stocks, land, a business, a house you've lived in for less than 2 years, etc.) Income tax and capital gains tax are two totally different things. Don't confuse the two. Capital gains are made in addition to regular income. A popular current news story is President Biden's proposal to raise the capital gains tax on wealthy Americans. The following table (taken from Investopedia) shows the current tax rates for capital gains. Tax Rates for Long-Term Capital Gains Filing Status 09 15% 20% Single $40,001 to Up to $40,000 $441,450 Over $441,450 . The details have not been confirmed, but the rumor is that Biden will raise the tax rate for those making over $441,450 in capital gains from 20% to 39.6%. You must show your work for all of the following calculations. Make sure your work is neat and organized! . 1. If a person makes $30,000 annually in capital gains, a. how much tax will they owe under the current system? b. how much more money will they owe under Biden's proposed system? 2. If a person makes $300,000 annually in capital gains, a. how much tax will they owe under the current system? b. how much more money will they owe under Biden's proposed system? 3. If a person makes $600,000 annually in capital gains, a. how much tax will they owe under the current system? b. How much more money will they owe under Biden's proposed system? 4. Do you support President Biden's proposed change? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts