Question: To save for a replacement machine for your assembly operation, your company will invest $10,000 each year for 5 years, starting exactly one year from

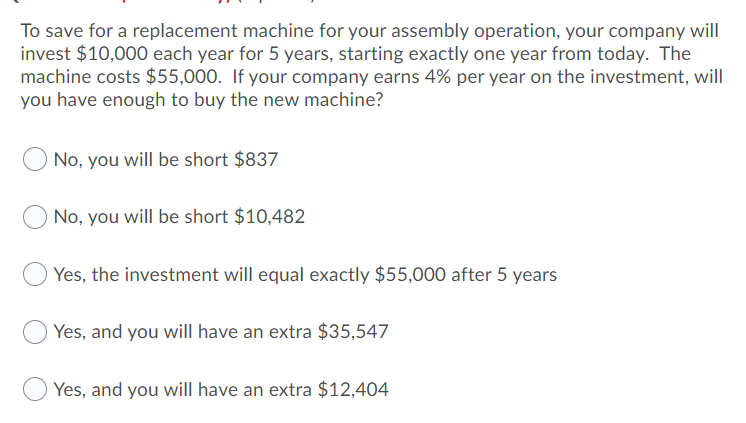

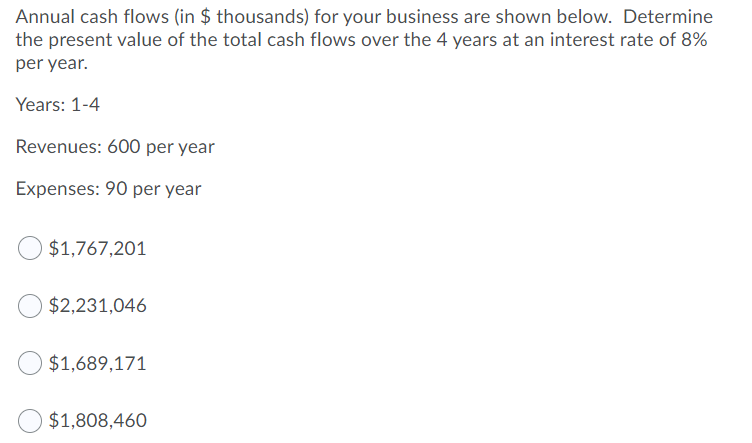

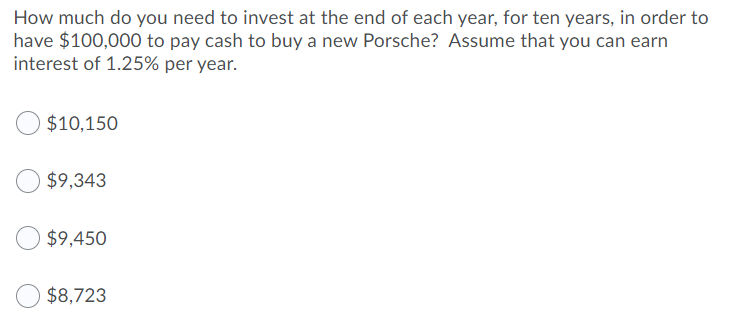

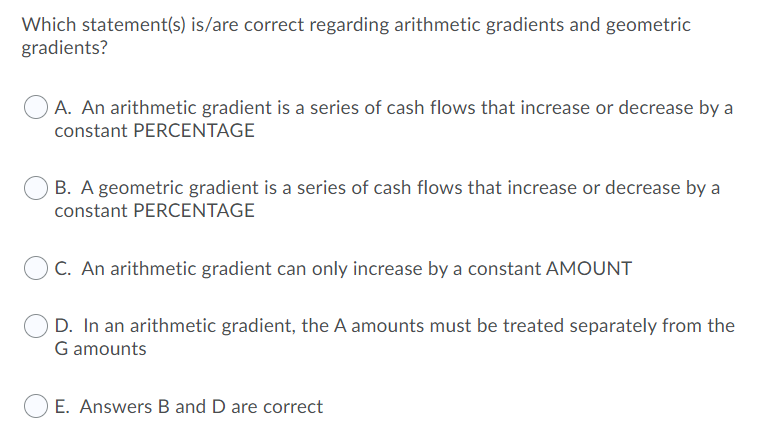

To save for a replacement machine for your assembly operation, your company will invest $10,000 each year for 5 years, starting exactly one year from today. The machine costs $55,000. If your company earns 4% per year on the investment, will you have enough to buy the new machine? 0 No, you will be short $837 0 No, you will be short $10,482 0 Yes, the investment will equal exactly $55,000 after 5 years 0 Yes, and you will have an extra $35,547 0 Yes, and you will have an extra $12,404 Annual cash flows [in $ thousands] for your business are shown below. Determine the present value of the total cash flows over the 4 years at an interest rate of 8% per year. Years: 1-4 Revenues: 600 per year Expenses: 90 per year 0 $1,767,201 0 $2,231,046 O $1,689,171 0 $1,803,460 How much do you need to invest at the end of each yea r, for ten years, in order to have $100,000 to pay cash to buy a new Porsche? Assume that you can earn interest of 1.25% per year. 0 $10,150 0 $9,343 0 $9,450 0 $3,723 Which statementis) is/are correct regarding arithmetic gradients and geometric gradients? O A. An arithmetic gradient is a series of cash flows that increase or decrease by a constant PERCENTAGE O B. A geometric gradient is a series of cash flows that increase or decrease by a constant PERCENTAGE O C. An arithmetic gradient can only increase by a constant AMOUNT O D. In an arithmetic gradient, the A amounts must be treated separately from the G amounts 0 E. Answers B and D are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts