Question: To save for future development, a company makes a deposit into a fund that earns interest at 6.45% compounded semi-annually. If the balance after 8

To save for future development, a company makes a deposit into a fund that earns interest at 6.45% compounded semi-annually. If the balance after 8 years needs to be $800,000, how much must be deposited at the end of each year?

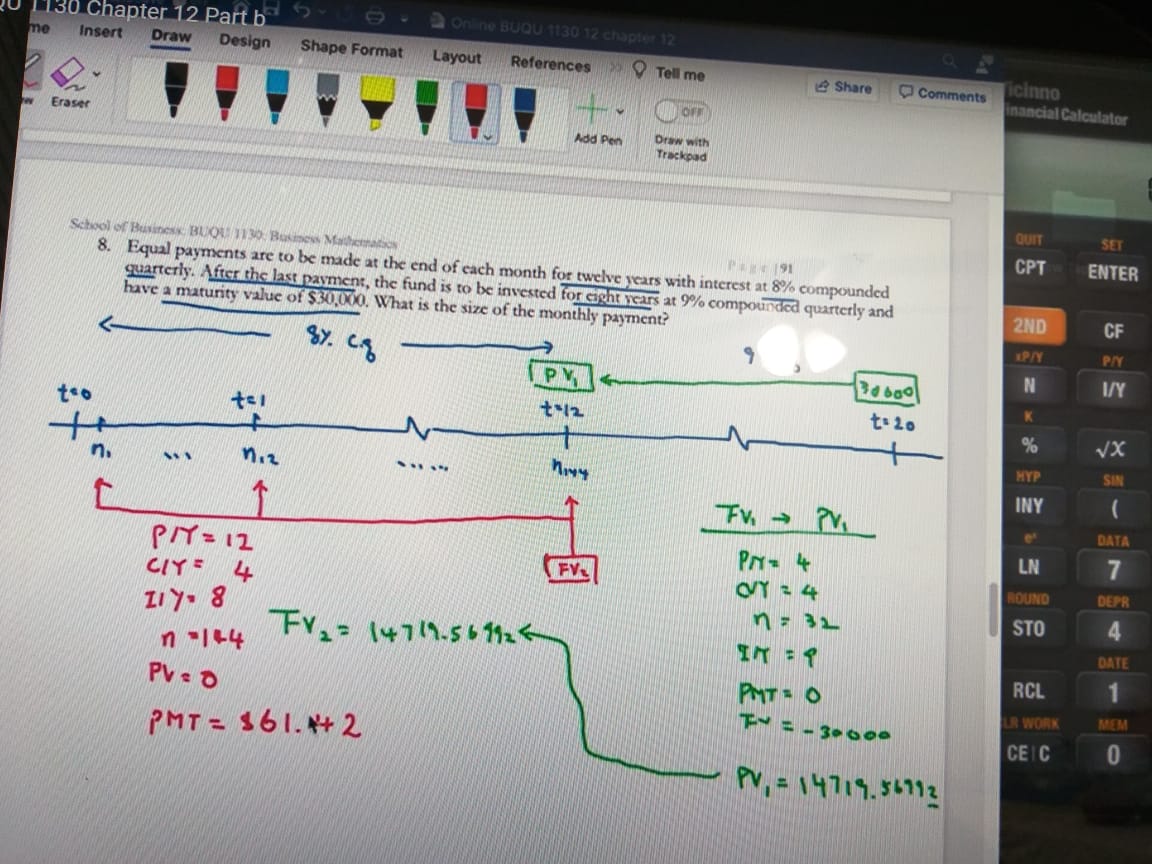

Please follow the example below. Kindly use BA II calculator. Thanks.

1 130 Chapter 12 Part b . 2Online BUQU 1130 12 chapter 12 me Insert Draw Design Shape Format Layout References s Tell me 2 Share Comments icinno inancial Calculator OFF Eraser Add Pen Draw with Trackpad QUIT SET School of Business, BUQU 1130, Bucco Matter CPT ENTER Per 191 8. Equal payments are to be made at the end of each month for twelve years with interest at 8% compounded quarterly. After the last payment, the fund is to be invested for eight years at 9% compounded quarterly and have a maturity value of $30,000. What is the size of the monthly payment? 2ND CF IPAY P/Y 8%. C.S 9 I/Y K to t: 12 t: 20 VX MYP SIN n. . .. INY ( Fv. - P. DATA P/ = 12 PM - 4 LN 7 FVL CIY = 4 CVT - 4 ROUND DEPR LIy- 8 n : 32 STO 4 n -124 FY2= 14719-5 61926 DATE RCL PV = 0 PMT = 0 R WORK MEM T. = - 30906 PMT = $61. 4+ 2 CEIC 0 PV, = 14719. 56712

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts