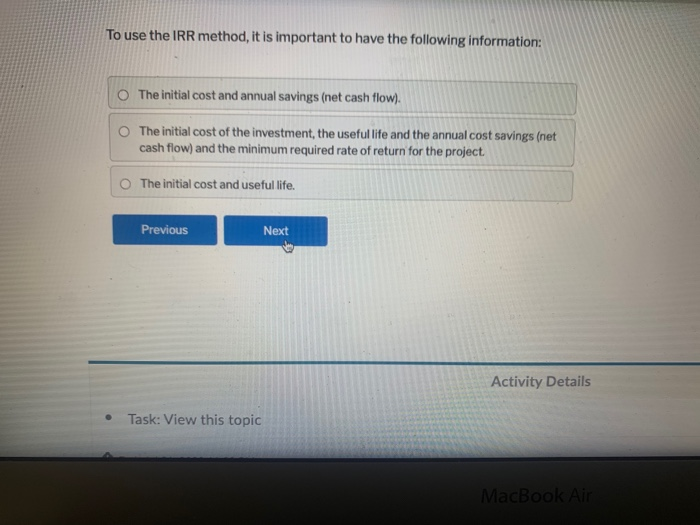

Question: To use the IRR method, it is important to have the following information: O The initial cost and annual savings (net cash flow). O The

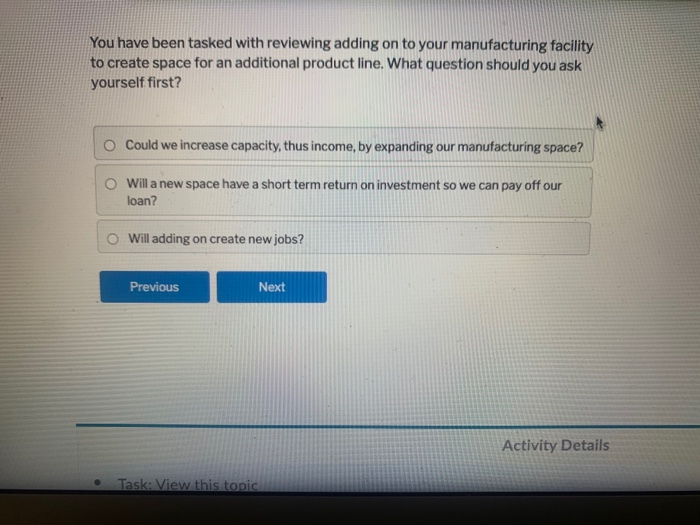

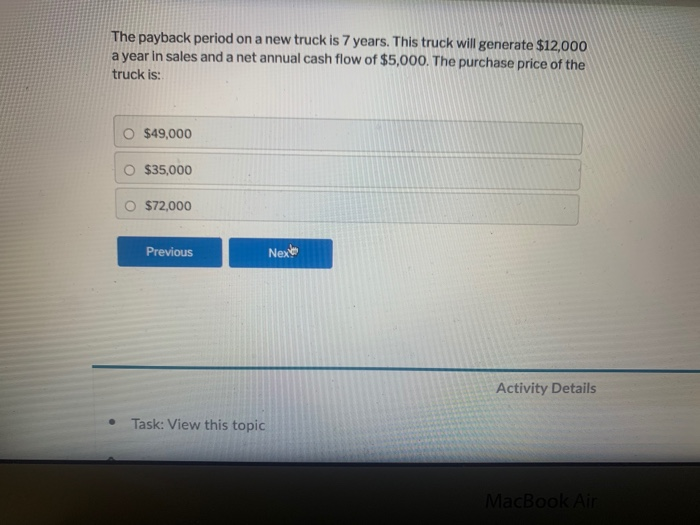

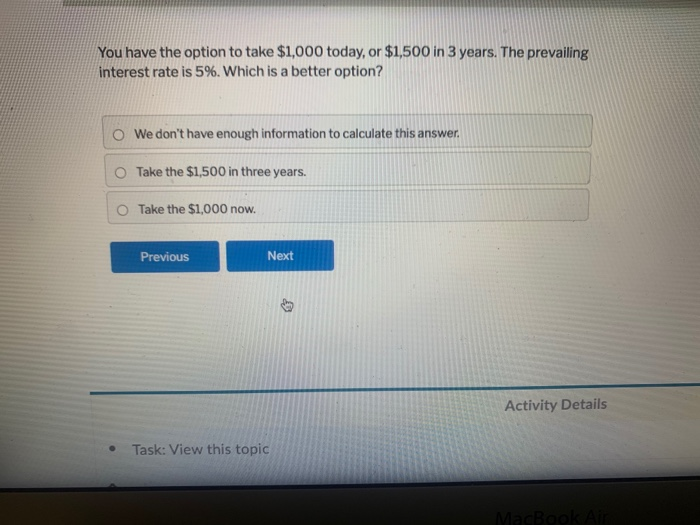

To use the IRR method, it is important to have the following information: O The initial cost and annual savings (net cash flow). O The initial cost of the investment, the useful life and the annual cost savings (net cash flow) and the minimum required rate of return for the project The initial cost and useful life. Previous Next Activity Details Task: View this topic MacBook Air You have been tasked with reviewing adding on to your manufacturing facility to create space for an additional product line. What question should you ask yourself first? O Could we increase capacity, thus income, by expanding our manufacturing space? O Will a new space have a short term return on investment so we can pay off our loan? Will adding on create new jobs? Previous Next Activity Details Task: View this topic The payback period on a new truck is 7 years. This truck will generate $12,000 a year in sales and a net annual cash flow of $5,000. The purchase price of the truck is: O $49,000 $35,000 O $72,000 Previous Next Activity Details Task: View this topic MacBook Air You have the option to take $1,000 today, or $1,500 in 3 years. The prevailing interest rate is 5%. Which is a better option? O We don't have enough information to calculate this answer Take the $1,500 in three years. O Take the $1,000 now. Previous Next Activity Details Task: View this topic MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts