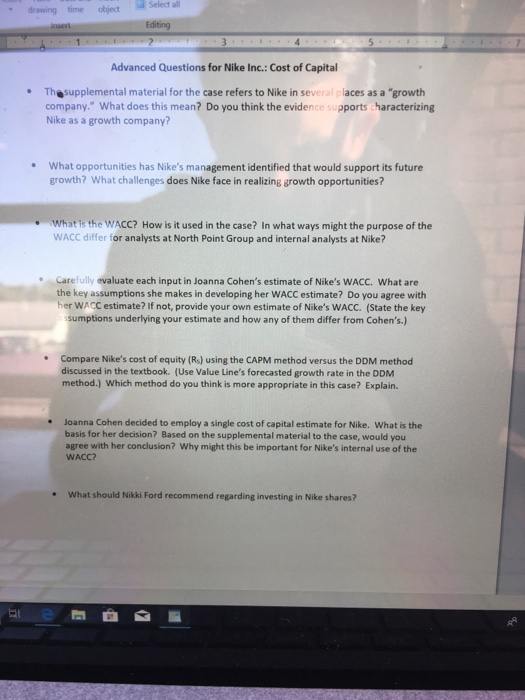

Question: To whom this may concern, Please answer the 7 bullet point. Thank you for your time. for M (no subject) - kwesto Case Materials: MB-5

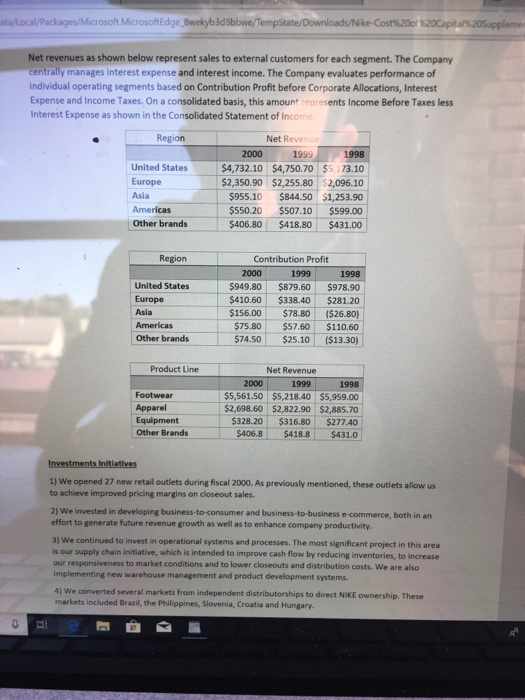

for M (no subject) - kwesto Case Materials: MB-5 Harvard Business Publ N ike-Cost of Capix appData/local Packages/Microsoft Microsoft Edge_8wekyb3d8bbwe/TempState/Downloads/Nike-Cost%2001%20Capital205upplem Nike, Inc. Case - Supplemental Information Excerpts from Nike Chairman and CEO Phil Knight's 2000 letter to shareholders I have said on more than one occasion that Nike is a growth company, even when sales go down. For the last two years, growth has been a state of mind...only. Our revenues have not grown. We have given the familiar reasons - and they have been good ones - U.S. industry cycle, the Asia meltdown, over-building in the U.S. retail market, etc. But I like you, am getting a little impatient for some revenue growth. We keep having some very good indicators: orders outside the U.S. increasing, U.S. apparel showing signs of growth, equipment becoming a meaningful piece of the ple, and a strong improvement in subsidiaries. But our greatest opportunity lies in our relationship with our consumers. The small nugget that drives us to be a better company is relatively simple: Consumers want Nike to succeed. Nice was, is, and will always be a company driven by certain key philosophies. First and foremost, we are a company dedicated to innovation and the passion to create great product. The consumer rules the roost. They make the important decisions. I answer to them, as we all do. The opinions of Wall Street analysts and media pundits are really just derivatives of our relationship with our consumers. When the young at heart seek out our products, when they respond to our messages and believe in what we stand for, when our relationship with consumers is healthy, that's when we grow. Over the past twenty-five years we have had to reinvent ourselves many times. Each time we reinvented our company. In 1995, when we reached $3 billion in sales, we said $5 billion was the absolute limit. Three years later we were closing in on $10 billion. We have stretched our Nike brand quite far. Some say too far. Others say it still has more reach to go. What is clear to me now is that the market has changed. We have new competitors and, as before, we need to adjust. We need to expand our connection to new categories and toward new consumers. My aspirations for Nike are simple: I want Nike to be the best company it can be." I want it "built to last." It must sustain beyond any team or any individual, including me. I won't be easy. There are a million reasons why we won't succeed. There will be challenges and road bumps along the way. Some will lose confidence. The Street and the media will be licking their chops. And the stock will fall, and the stock will rise. We have to be prudent and manage a tight ship. But, if the time comes to choose between managing our short-term earnings and creating long-term success, choose the latter. If that means taking another hit with the stock, then I'm willing to live with that. Phillip K. Knight Board Chairman and CEO,Nike Inc. patio dages/Microsoft Microsoft Edge_8wekyb3d8bbwe/TempState/Downloads/Nike-Cost%2001%20Capital%20Supplement 20 Operating Highlights by Region Americas There were quite a few encouraging signs for us in the USA over the past 12 months. Footwear revenues increased for the first time since fiscal 1997. Not much to brag about for a growth company, but the sales gain was achieved in a retail environment that saw significant square footage consolidation. The explosive store growth among athletic footwear retailers that helped drive industry growth through much of the '90s slowed abruptly over the past 12 months While our USA footwear revenues grew only three percent in fiscal 2000, it was accomplished in a manner that helped stabilize a sometimes volatile retail marketplace. Our growth was driven by compelling product-Tuned Air Presto, Air Kukini, Jordan XV. That felt good. Our mission is to make compelling product that excites consumers. At the end of the day, that's where Nike lives. While sales from outside the USA will be our key revenue driver over the coming years, it is critical we capture the opportunities for growth in the USA, our largest market. We will continue to seek the bulk of our regional growth in businesses such as Women's, Golf and ACG, where we remain under penetrated. We believe we can also grow our core franchises by developing innovative product. Our USA apparel business saw revenues decrease 11 percent in fiscal 2000. Not good. Even though our USA apparel business is less than a third the size of our USA footwear business, the ship has proven more difficult to turn around. We are still in the process of becoming a good apparel company in the USA. We made strides toward that end in the past year. Through all the trials of the past few years in the USA, one constant remains. For consumers, Nike stands for authenticity. Europe In the face of a woefully weak Euro, our European revenues grew four percent in fiscal 2000. Had the U.S. dollar remained constant at prior year levels, sales would have increased 15 percent. The 15 percent constant dollar revenue growth this past year was particularly challenging. Gross margins improved considerably. Our distribution center in Laakdal, Belgium continues to provide a competitive advantage for us in the marketplace But at the end of the day, it comes down to product. Much of our apparel and a growing piece of our footwear that we sell in Europe is designed there, so we are able to live and breathe the same air as our consumers. Two happenings best illustrate the accomplishments of our European team in fiscal 2000. The first is a place: the intersection of youth, culture and sport at the northeast corner of Regent and Oxford Streets in London. Also known as Niketown London, the store opened in July 1999. The success of the store can only be measured in part by the 15 percent increase we saw in U.K. revenues for the year. More importantly, it's a place for consumers to live the Nike brand with the same passion as our European team PI do Prison Asia Starting at the end of Fiscal 1998, we got knocked pretty silly in Asia Pacific. Revenues dropped by about one-third, Japan, which accounted for half of our Asia Pacific revenues, was awash with excess inventory. We spent much of fiscal 1999 in rehab, reducing our regional cost structure and putting in place a plan designed to capitalize on the abundant opportunities in the marketplace. Over the past year, we began to harvest the first fruit from that organization. While revenues grew at 13 percent (or five percent in constant dollars), profitability improved quite dramatically. Gross margins saw marked improvement in fiscal 2000 and, although they did not reach the peak levels of a few years back, we are enthused about the potential to drive strong cross margin performance going forward. We also leveraged our lower cost structures nificantly. Japan remains the bellwether market for us in Asia Pacific and our recovery there in fiscal 2000 reflects our ability to adapt to rapidly shifting consumer tastes. Innovations have consistently drawn Japanese consumers to Nike products and cutting-edge introductions such as the Presto and Air Kukini have helped re-ignite demand. Japan, however, is something of an aberration relative to most other markets in the region. In many emerging markets, the cost of a current Nike shoe can be too expensive for most young people who are passionate about sports. Our World Shoe Project provides regions like China and Southeast Asia with a line of affordable athletic shoes that meet specific sport needs, and are designed and manufactured with proven Nike technology, Shoe costs are kept low because there are fewer and less expensive mponents than the current more sophisticated models, lower transportation and shipping costs, and no import duties. Operating Performance Total NIKE revenues increased by 2.5% in fiscal 2000. Revenues in the United States region were flat as compared to last year while revenues in our international regions increased 6.9%. Revenue growth in the United States was slowed by a contraction of athletic sportswear retail space, which we expect to continue to affect our revenue growth during the first part of fiscal 2001. U.S.footwear revenues rose 3.3%, reflecting slightly higher volumes on average prices that were relatively equal to last year. Apparel revenues, however, decreased by 10.7% as demand for in-line products fell, and cleaner inventories in fiscal 2000 resulted in fewer closeout sales than in fiscal 1999 In fiscal 2000, revenues from our international regions represented 42.9% of total company revenues and grew significantly during the year. In our Asia Pacific region, revenues grew 13.15 4.7% increase in constant dollars. The Americas region, which includes Canada, Central and South America, and Africa grew revenues 8.5%, 10.6in constant dollars. Operating Segments For subsidiaries participating in NIKE Brand sales activity, the Company's major operating segments are defined by geographic regions. The segments are evidence of the structure of the enterprise's internal organization. Each NIKE Brand geographic segment operates predominantly in one industry, the design production, marketing and selling of sports and fitness footwear, apparel and equipment talocal/Packages Microsoft Microsoft Edge Swekyb3dbbwe/TempState/Downloads/Nike-Cost%2020Capita20Suppleme Net revenues as shown below represent sales to external customers for each segment. The Company centrally manages interest expense and interest income. The Company evaluates performance of individual operating segments based on Contribution Profit before Corporate Allocations, Interest Expense and Income Taxes. On a consolidated basis, this amount presents Income Before Taxes less Interest Expense as shown in the Consolidated Statement of Income Region United States Europe Net Revenue 2000 1999 1998 $4,732.10 $4,750.70 $5.173.10 $2,350.90 $2,255.80 $2,096.10 $955.10 $844.50 $1,253.90 $550.20 $507.10 $599.00 $406.80 $418.80 $431.00 Asia Americas Other brands Region United States Europe Asia Americas Other brands Contribution Profit 2000 1999 1998 $949.80 $879.60 $978.90 $410.60 $338.40 $281.20 $156.00 $78.80 (526.80) $75.80 $57.60 $110.60 $74.50 $25.10 ($13.30) Product Line Footwear Apparel Equipment Other Brands Net Revenue 2000 1999 $5,561.50 $5,218.40 $2,698.60 $2,822.90 $328.20 $316.80 $406.8 $418.8 1998 $5,959.00 $2,885.70 $277.40 $431.0 Investments Initiatives 1) We opened 27 new retail outlets during fiscal 2000. As previously mentioned, these outlets allow us to achieve improved pricing margins on closeout sales. 2) We invested in developing business-to-consumer and business-to-business e-commerce, both in an effort to generate future revenue growth as well as to enhance company productivity. 3) We continued to invest in operational systems and processes. The most significant project in this area is our supply chain initiative, which is intended to improve cash flow by reducing inventories, to increase our responsiveness to market conditions and to lower closeouts and distribution costs. We are also implementing new warehouse management and product development systems. 4) We converted several markets from independent distributorships to direct NIKE ownership. These markets included Brasil, the Philippines, Slovenia, Croatia and Hungary for M (no subject) - kwesto Case Materials: MB-5 Harvard Business Publ N ike-Cost of Capix appData/local Packages/Microsoft Microsoft Edge_8wekyb3d8bbwe/TempState/Downloads/Nike-Cost%2001%20Capital205upplem Nike, Inc. Case - Supplemental Information Excerpts from Nike Chairman and CEO Phil Knight's 2000 letter to shareholders I have said on more than one occasion that Nike is a growth company, even when sales go down. For the last two years, growth has been a state of mind...only. Our revenues have not grown. We have given the familiar reasons - and they have been good ones - U.S. industry cycle, the Asia meltdown, over-building in the U.S. retail market, etc. But I like you, am getting a little impatient for some revenue growth. We keep having some very good indicators: orders outside the U.S. increasing, U.S. apparel showing signs of growth, equipment becoming a meaningful piece of the ple, and a strong improvement in subsidiaries. But our greatest opportunity lies in our relationship with our consumers. The small nugget that drives us to be a better company is relatively simple: Consumers want Nike to succeed. Nice was, is, and will always be a company driven by certain key philosophies. First and foremost, we are a company dedicated to innovation and the passion to create great product. The consumer rules the roost. They make the important decisions. I answer to them, as we all do. The opinions of Wall Street analysts and media pundits are really just derivatives of our relationship with our consumers. When the young at heart seek out our products, when they respond to our messages and believe in what we stand for, when our relationship with consumers is healthy, that's when we grow. Over the past twenty-five years we have had to reinvent ourselves many times. Each time we reinvented our company. In 1995, when we reached $3 billion in sales, we said $5 billion was the absolute limit. Three years later we were closing in on $10 billion. We have stretched our Nike brand quite far. Some say too far. Others say it still has more reach to go. What is clear to me now is that the market has changed. We have new competitors and, as before, we need to adjust. We need to expand our connection to new categories and toward new consumers. My aspirations for Nike are simple: I want Nike to be the best company it can be." I want it "built to last." It must sustain beyond any team or any individual, including me. I won't be easy. There are a million reasons why we won't succeed. There will be challenges and road bumps along the way. Some will lose confidence. The Street and the media will be licking their chops. And the stock will fall, and the stock will rise. We have to be prudent and manage a tight ship. But, if the time comes to choose between managing our short-term earnings and creating long-term success, choose the latter. If that means taking another hit with the stock, then I'm willing to live with that. Phillip K. Knight Board Chairman and CEO,Nike Inc. patio dages/Microsoft Microsoft Edge_8wekyb3d8bbwe/TempState/Downloads/Nike-Cost%2001%20Capital%20Supplement 20 Operating Highlights by Region Americas There were quite a few encouraging signs for us in the USA over the past 12 months. Footwear revenues increased for the first time since fiscal 1997. Not much to brag about for a growth company, but the sales gain was achieved in a retail environment that saw significant square footage consolidation. The explosive store growth among athletic footwear retailers that helped drive industry growth through much of the '90s slowed abruptly over the past 12 months While our USA footwear revenues grew only three percent in fiscal 2000, it was accomplished in a manner that helped stabilize a sometimes volatile retail marketplace. Our growth was driven by compelling product-Tuned Air Presto, Air Kukini, Jordan XV. That felt good. Our mission is to make compelling product that excites consumers. At the end of the day, that's where Nike lives. While sales from outside the USA will be our key revenue driver over the coming years, it is critical we capture the opportunities for growth in the USA, our largest market. We will continue to seek the bulk of our regional growth in businesses such as Women's, Golf and ACG, where we remain under penetrated. We believe we can also grow our core franchises by developing innovative product. Our USA apparel business saw revenues decrease 11 percent in fiscal 2000. Not good. Even though our USA apparel business is less than a third the size of our USA footwear business, the ship has proven more difficult to turn around. We are still in the process of becoming a good apparel company in the USA. We made strides toward that end in the past year. Through all the trials of the past few years in the USA, one constant remains. For consumers, Nike stands for authenticity. Europe In the face of a woefully weak Euro, our European revenues grew four percent in fiscal 2000. Had the U.S. dollar remained constant at prior year levels, sales would have increased 15 percent. The 15 percent constant dollar revenue growth this past year was particularly challenging. Gross margins improved considerably. Our distribution center in Laakdal, Belgium continues to provide a competitive advantage for us in the marketplace But at the end of the day, it comes down to product. Much of our apparel and a growing piece of our footwear that we sell in Europe is designed there, so we are able to live and breathe the same air as our consumers. Two happenings best illustrate the accomplishments of our European team in fiscal 2000. The first is a place: the intersection of youth, culture and sport at the northeast corner of Regent and Oxford Streets in London. Also known as Niketown London, the store opened in July 1999. The success of the store can only be measured in part by the 15 percent increase we saw in U.K. revenues for the year. More importantly, it's a place for consumers to live the Nike brand with the same passion as our European team PI do Prison Asia Starting at the end of Fiscal 1998, we got knocked pretty silly in Asia Pacific. Revenues dropped by about one-third, Japan, which accounted for half of our Asia Pacific revenues, was awash with excess inventory. We spent much of fiscal 1999 in rehab, reducing our regional cost structure and putting in place a plan designed to capitalize on the abundant opportunities in the marketplace. Over the past year, we began to harvest the first fruit from that organization. While revenues grew at 13 percent (or five percent in constant dollars), profitability improved quite dramatically. Gross margins saw marked improvement in fiscal 2000 and, although they did not reach the peak levels of a few years back, we are enthused about the potential to drive strong cross margin performance going forward. We also leveraged our lower cost structures nificantly. Japan remains the bellwether market for us in Asia Pacific and our recovery there in fiscal 2000 reflects our ability to adapt to rapidly shifting consumer tastes. Innovations have consistently drawn Japanese consumers to Nike products and cutting-edge introductions such as the Presto and Air Kukini have helped re-ignite demand. Japan, however, is something of an aberration relative to most other markets in the region. In many emerging markets, the cost of a current Nike shoe can be too expensive for most young people who are passionate about sports. Our World Shoe Project provides regions like China and Southeast Asia with a line of affordable athletic shoes that meet specific sport needs, and are designed and manufactured with proven Nike technology, Shoe costs are kept low because there are fewer and less expensive mponents than the current more sophisticated models, lower transportation and shipping costs, and no import duties. Operating Performance Total NIKE revenues increased by 2.5% in fiscal 2000. Revenues in the United States region were flat as compared to last year while revenues in our international regions increased 6.9%. Revenue growth in the United States was slowed by a contraction of athletic sportswear retail space, which we expect to continue to affect our revenue growth during the first part of fiscal 2001. U.S.footwear revenues rose 3.3%, reflecting slightly higher volumes on average prices that were relatively equal to last year. Apparel revenues, however, decreased by 10.7% as demand for in-line products fell, and cleaner inventories in fiscal 2000 resulted in fewer closeout sales than in fiscal 1999 In fiscal 2000, revenues from our international regions represented 42.9% of total company revenues and grew significantly during the year. In our Asia Pacific region, revenues grew 13.15 4.7% increase in constant dollars. The Americas region, which includes Canada, Central and South America, and Africa grew revenues 8.5%, 10.6in constant dollars. Operating Segments For subsidiaries participating in NIKE Brand sales activity, the Company's major operating segments are defined by geographic regions. The segments are evidence of the structure of the enterprise's internal organization. Each NIKE Brand geographic segment operates predominantly in one industry, the design production, marketing and selling of sports and fitness footwear, apparel and equipment talocal/Packages Microsoft Microsoft Edge Swekyb3dbbwe/TempState/Downloads/Nike-Cost%2020Capita20Suppleme Net revenues as shown below represent sales to external customers for each segment. The Company centrally manages interest expense and interest income. The Company evaluates performance of individual operating segments based on Contribution Profit before Corporate Allocations, Interest Expense and Income Taxes. On a consolidated basis, this amount presents Income Before Taxes less Interest Expense as shown in the Consolidated Statement of Income Region United States Europe Net Revenue 2000 1999 1998 $4,732.10 $4,750.70 $5.173.10 $2,350.90 $2,255.80 $2,096.10 $955.10 $844.50 $1,253.90 $550.20 $507.10 $599.00 $406.80 $418.80 $431.00 Asia Americas Other brands Region United States Europe Asia Americas Other brands Contribution Profit 2000 1999 1998 $949.80 $879.60 $978.90 $410.60 $338.40 $281.20 $156.00 $78.80 (526.80) $75.80 $57.60 $110.60 $74.50 $25.10 ($13.30) Product Line Footwear Apparel Equipment Other Brands Net Revenue 2000 1999 $5,561.50 $5,218.40 $2,698.60 $2,822.90 $328.20 $316.80 $406.8 $418.8 1998 $5,959.00 $2,885.70 $277.40 $431.0 Investments Initiatives 1) We opened 27 new retail outlets during fiscal 2000. As previously mentioned, these outlets allow us to achieve improved pricing margins on closeout sales. 2) We invested in developing business-to-consumer and business-to-business e-commerce, both in an effort to generate future revenue growth as well as to enhance company productivity. 3) We continued to invest in operational systems and processes. The most significant project in this area is our supply chain initiative, which is intended to improve cash flow by reducing inventories, to increase our responsiveness to market conditions and to lower closeouts and distribution costs. We are also implementing new warehouse management and product development systems. 4) We converted several markets from independent distributorships to direct NIKE ownership. These markets included Brasil, the Philippines, Slovenia, Croatia and Hungary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts