Question: Toby Company uses a normal job costing system and allocates overhead to jobs using a predetermined overhead rate based on direct labor cost. Budgeted and

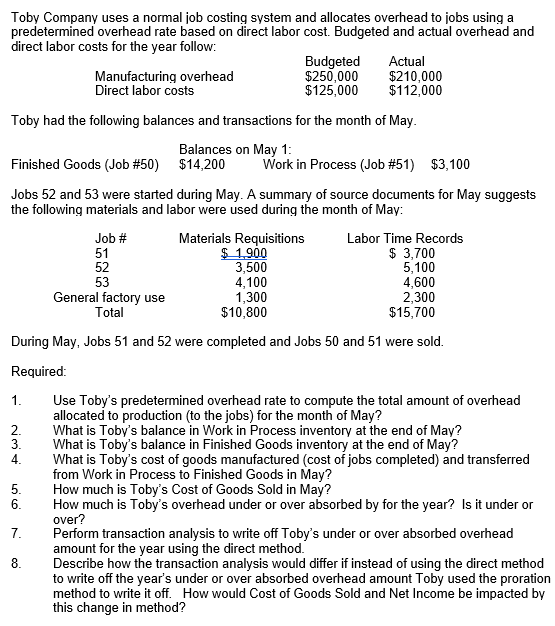

Toby Company uses a normal job costing system and allocates overhead to jobs using a

predetermined overhead rate based on direct labor cost. Budgeted and actual overhead and

direct labor costs for the year follow:

Toby had the following balances and transactions for the month of May.

Jobs and were started during May. A summary of source documents for May suggests

the following materials and labor were used during the month of May:

During May, Jobs and were completed and Jobs and were sold.

Required:

Use Toby's predetermined overhead rate to compute the total amount of overhead

allocated to production to the jobs for the month of May?

What is Toby's balance in Work in Process inventory at the end of May?

What is Toby's balance in Finished Goods inventory at the end of May?

What is Toby's cost of goods manufactured cost of jobs completed and transferred

from Work in Process to Finished Goods in May?

How much is Toby's Cost of Goods Sold in May?

How much is Toby's overhead under or over absorbed by for the year? Is it under or

over?

Perform transaction analysis to write off Toby's under or over absorbed overhead

amount for the year using the direct method.

Describe how the transaction analysis would differ if instead of using the direct method

to write off the year's under or over absorbed overhead amount Toby used the proration

method to write it off. How would Cost of Goods Sold and Net Income be impacted by

this change in method?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock