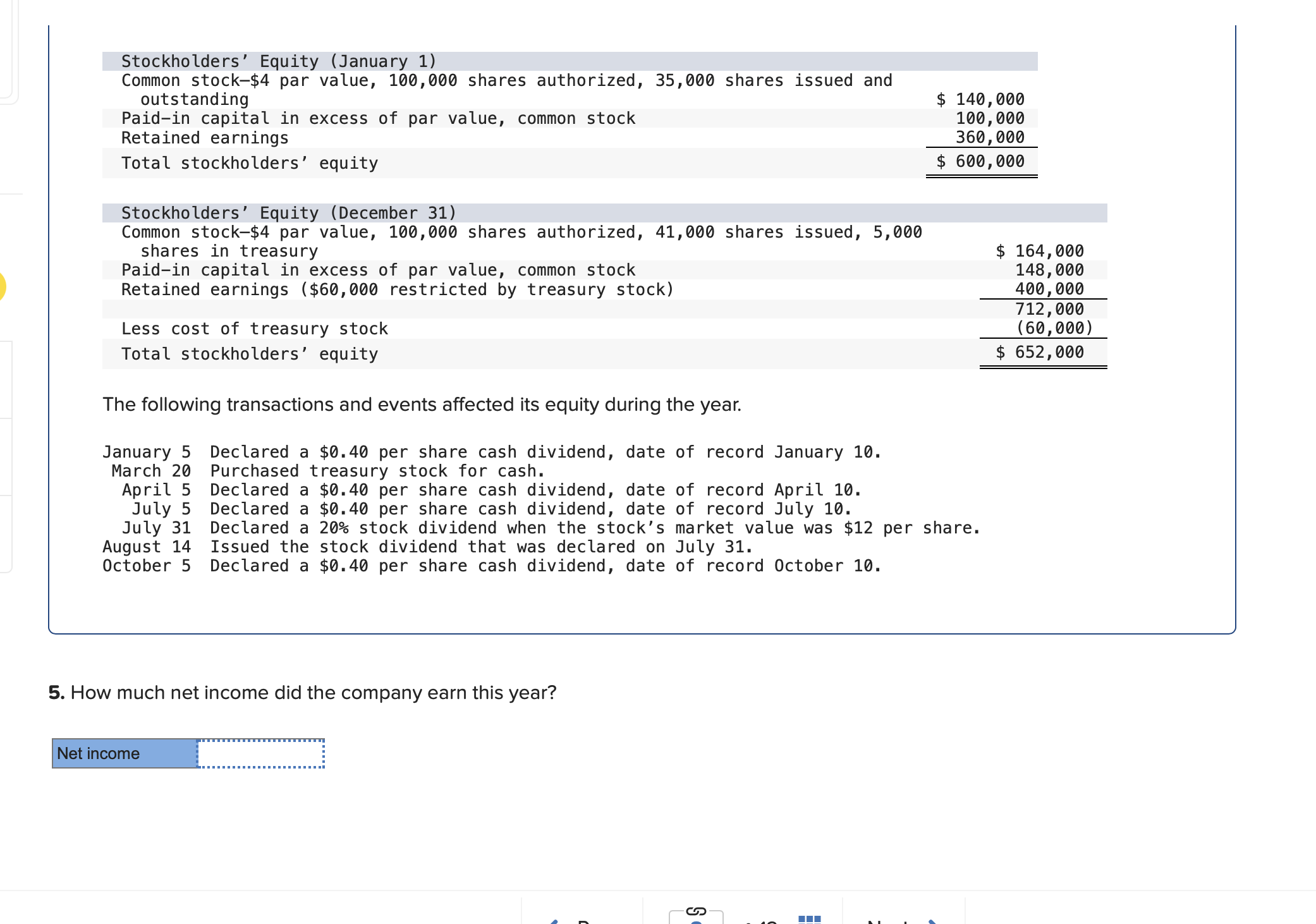

Question: tockholders Equity ( January 1 ) Common stock $ 4 par value, 1 0 0 , 0 0 0 shares authorized, 3 5 , 0

tockholders Equity January Common stock$ par value, shares authorized, shares issued and outstanding$ Paidin capital in excess of par value, common stockRetained earningsTotal stockholders equity$

Stockholders Equity December Common stock$ par value, shares authorized, shares issued, shares in treasury$ Paidin capital in excess of par value, common stockRetained earnings $ restricted by treasury stockLess cost of treasury stockTotal stockholders equity$

The following transactions and events affected its equity during the year.

January Declared a $ per share cash dividend, date of record January March Purchased treasury stock for cash.April Declared a $ per share cash dividend, date of record April July Declared a $ per share cash dividend, date of record July July Declared a stock dividend when the stocks market value was $ per share.August Issued the stock dividend that was declared on July October Declared a $ per share cash dividend, date of record October

The following transactions and events affected its equity during the year.

January Declared a $ per share cash dividend, date of record January

March Purchased treasury stock for cash.

April Declared a $ per share cash dividend, date of record April

July Declared a $ per share cash dividend, date of record July

July Declared a stock dividend when the stock's market value was $ per share.

August Issued the stock dividend that was declared on July

October Declared a $ per share cash dividend, date of record October

How much net income did the company earn this year?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock