Question: Tocor is considering the implementation of a lockbox collection system for its mid- western and western sales regions. Sales in those two regions are 30

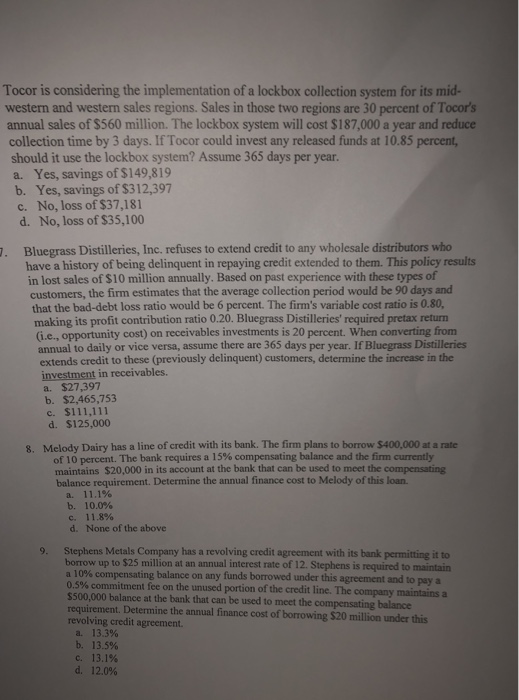

Tocor is considering the implementation of a lockbox collection system for its mid- western and western sales regions. Sales in those two regions are 30 percent of Tocors annual sales of $560 million. The lockbox system will cost $187,000 a year and reduce collection time by 3 days. If Tocor could invest any released funds at 10.85 percent, should it use the lockbox system? Assume 365 days per year. a. Yes, savings of $149,819 b. Yes, savings of $312,397 c. No, loss of $37,181 d. No, loss of $35,100 Bluegrass Distilleries, Inc. refuses to extend credit to any wholesale distributors who in lost sales of $10 million annually. Based on past experience with these types of that the bad-debt loss ratio would be 6 percent. The firm's variable cost ratio is 0.80, (i.e., opportunity cost) on receivables investments is 20 percent. When converting . have a history of being delinquent in repaying credit extended to them. This policy results customers, the firm estimates that the average collection period would be 90 days and making its profit contribution ratio 0.20. Bluegrass Distilleries' required pretax return from annual to daily or vice versa, assume there are 365 days per year. If Bluegrass Distilleries extends credit to these (previously delinquent) customers, determine the increase in the a. $27,397 b. $2,465,753 c. $111,111 d. $125,000 8. Melody Dairy has a line of credit with its bank. The firm plans to borrow $400,000 at a rate of 10 percent. The bank requires a 15% compensating balance and the firm currently maintains $20,000 in its account at the bank that can be used to meet the compensating balance requirement. Determine the annual finance cost to Melody of this loan. b. 10.0% ?. d. 11.8% None of the above 9. Stephens Metals Company has a revolving credit agreement with its bank permitting it to up to $25 million at an annual interest rate of 12. Stephens is required to maintain a 10% compensating balance on any funds borrowed under this agreement and to pay a 0.5% commitment fee on the unused portion of the credit line. The company maintains a $500,000 balance at the bank that can be used to meet the compensating balance requirement. Determine the annual finance cost of borrowing $20 million under this revolving credit agreement a. b. c. d. 13.3% 13.5% 13.1% 12.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts