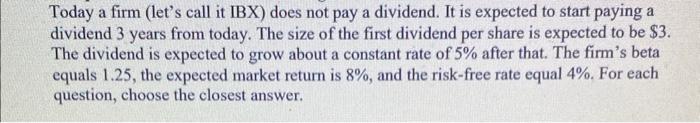

Question: Today a firm (let's call it IBX) does not pay a dividend. It is expected to start paying a dividend 3 years from today. The

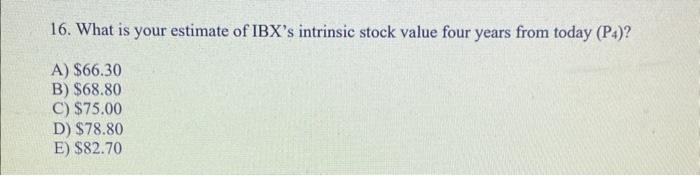

Today a firm (let's call it IBX) does not pay a dividend. It is expected to start paying a dividend 3 years from today. The size of the first dividend per share is expected to be $3. The dividend is expected to grow about a constant rate of 5% after that. The firm's beta equals 1.25 , the expected market return is 8%, and the risk-free rate equal 4%. For each question, choose the closest answer. 16. What is your estimate of IBX's intrinsic stock value four years from today (P4) ? A) $66.30 B) $68.80 C) $75.00 D) $78.80 E) $82.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts