Question: Today, the continuous compound interest rate is 0.1% and one share of Amazon is $2367.92. 1. What price do you expect Amazon to be 6

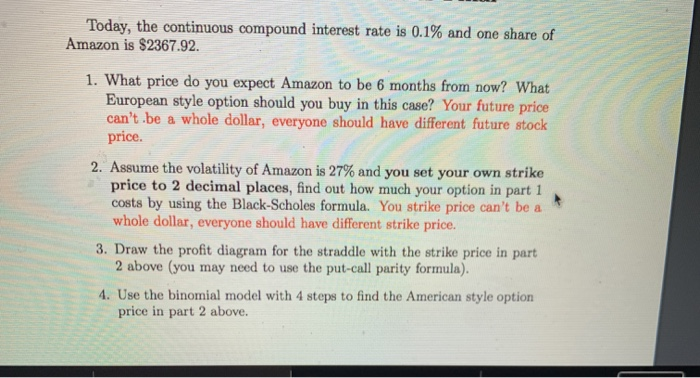

Today, the continuous compound interest rate is 0.1% and one share of Amazon is $2367.92. 1. What price do you expect Amazon to be 6 months from now? What European style option should you buy in this case? Your future price can't be a whole dollar, everyone should have different future stock price. 2. Assume the volatility of Amazon is 27% and you set your own strike price to 2 decimal places, find out how much your option in part 1 costs by using the Black-Scholes formula. You strike price can't be a whole dollar, everyone should have different strike price. 3. Draw the profit diagram for the straddle with the strike price in part 2 above (you may need to use the put-call parity formula) 4. Use the binomial model with 4 steps to find the American style option price in part 2 above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts