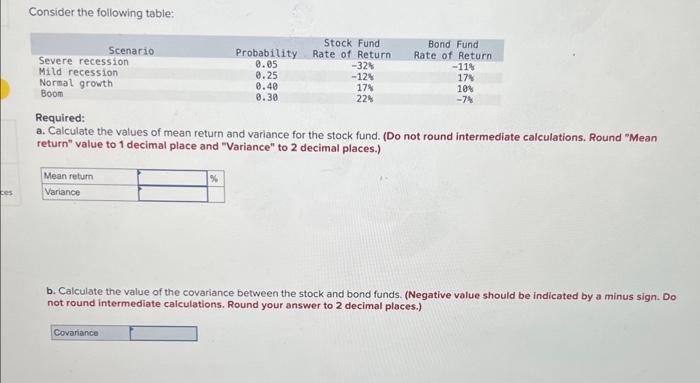

Question: together Consider the following table: Required: a. Calculate the values of mean return and variance for the stock fund. (Do not round intermediate calculations. Round

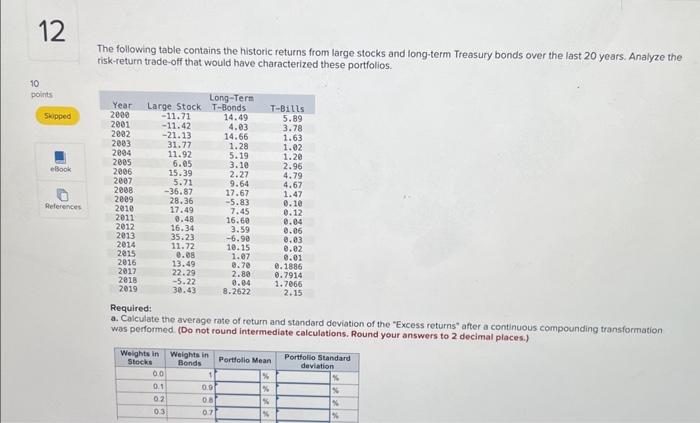

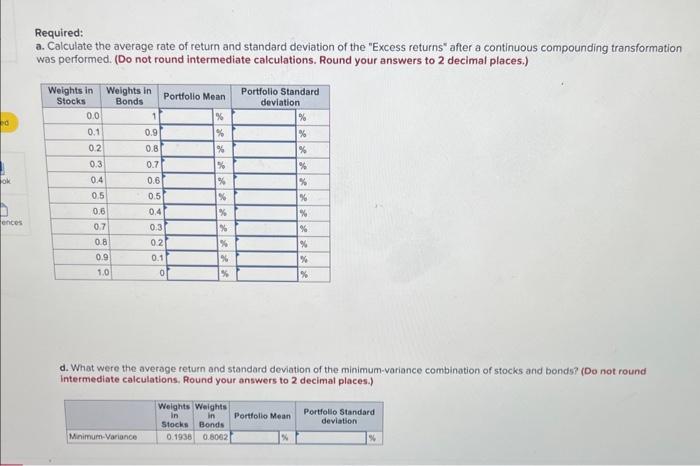

Consider the following table: Required: a. Calculate the values of mean return and variance for the stock fund. (Do not round intermediate calculations. Round "Mean return" value to 1 decimal place and "Variance" to 2 decimal places.) b. Calculate the value of the covariance between the stock and bond funds. (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) The following table contains the historic returns from large stocks and long-term Treasury bonds over the last 20 years. Analyze the risk-return trade-off that would have characterized these portfolios. Required: a. Calculate the average rate of return and standard deviation of the "Excess returns" after a continuous compounding transformation. was performed (Do not round intermediate calculations. Round your answers to 2 decimal places.) Required: a. Calculate the average rate of return and standard deviation of the "Excess returns" after a continuous compounding transformation was performed. (Do not round intermediate calculations. Round your answers to 2 decimal places.) d. What were the average return and standard deviation of the minimum-variance combination of stocks and bonds? (Do not round Intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts