Question: TOLL ALL Aabble AaBbcc AdB AaBbcccdasCeDealCode da CD 1 Normal No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em. Emphasis intense aragraph Styles Chapter

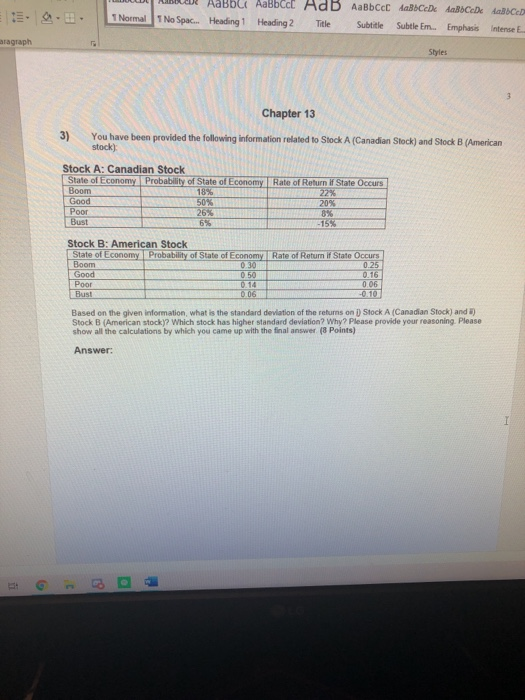

TOLL ALL Aabble AaBbcc AdB AaBbcccdasCeDealCode da CD 1 Normal No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em. Emphasis intense aragraph Styles Chapter 13 You have been provided the following information related to Stock A (Canadian Stock) and Stock B (American stock) Stock A: Canadian Stock State of Economy Probability of State of Economy Rate of Return of State Occurs Boom 22% Good 2093 Poor Bust -15% Stock B: American Stock State of Economy Probability of State of Economy Rate of Return if State Occurs 0.25 016 Poor 0.06 Bust Based on the given information, what is the standard deviation of the returns on Stock A (Canadian Stock) and 3) Stock B American stock? Which stock has higher standard deviation? Why? Please provide your reasoning, Please show all the calculations by which you came up with the final answer ( Points) 0.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts