Question: Tom sold a put option to Kyle. The contract term on the option is as below. Underlying asset: AAPL Exercise price = $160 Current price

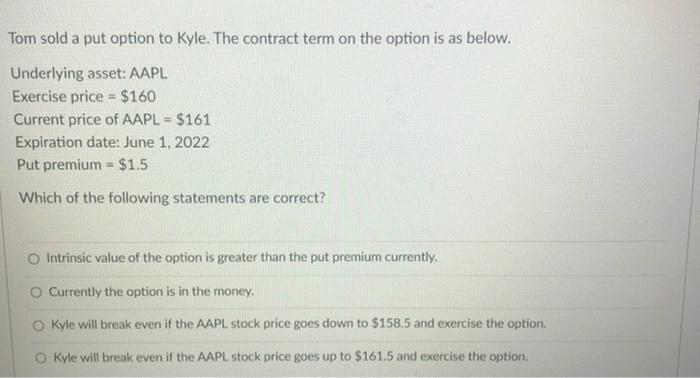

Tom sold a put option to Kyle. The contract term on the option is as below. Underlying asset: AAPL Exercise price = $160 Current price of AAPL = $161 Expiration date: June 1, 2022 Put premium = $1.5 Which of the following statements are correct? Intrinsic value of the option is greater than the put premium currently. Currently the option is in the money. Kyle will break even if the AAPL stock price goes down to $158.5 and exercise the option. Kyle will break even if the AAPL stock price goes up to $161.5 and exercise the option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock