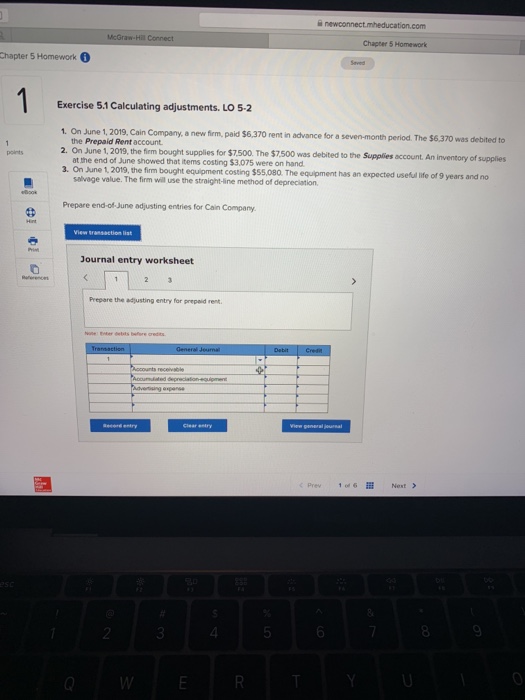

Question: ton.com Chapter 5 Homework Chapter 5 Homework Exercise 5.1 Calculating adjustments. LO 5-2 1. On June 1, 2019, Cain Company, a new firm, paid $6,370

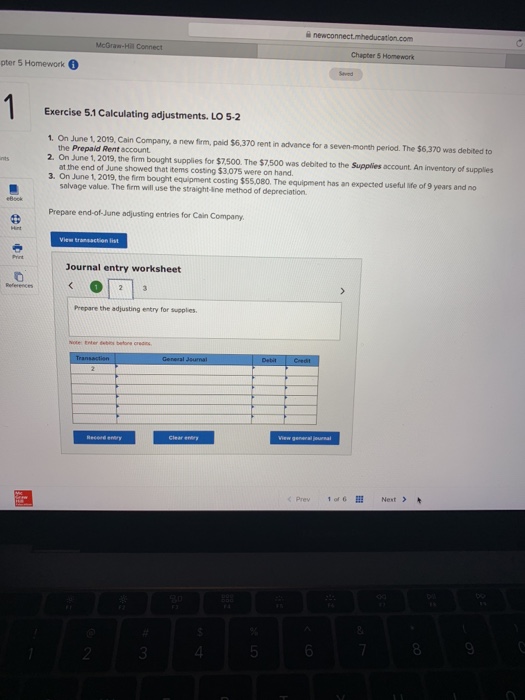

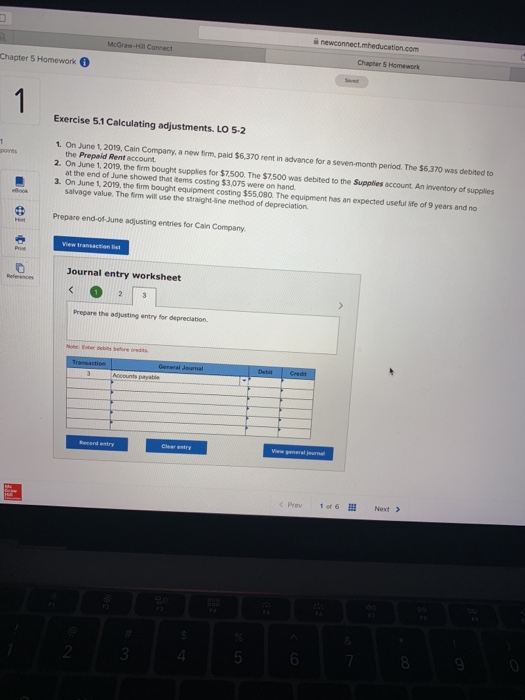

ton.com Chapter 5 Homework Chapter 5 Homework Exercise 5.1 Calculating adjustments. LO 5-2 1. On June 1, 2019, Cain Company, a new firm, paid $6,370 rent in advance for a seven-month period. The $6,370 was debited to the Prepaid Rent account at the end of June showed that items costing $3.075 were on hand salvage value. The firm will use the straight-line method of deprecisation, points 2. On June 1, 2019, the fim bought supplies for $7.500. The $7,500 was debited to the Supplies account was debited to the Supplies account. An inventory of supplies 3. On June 1, 2019, the fim bought equipment costing $$5,080. The equipment has an expected useful life of 9 years and no Prepare end-of-June adjusting entries for Cain Company Journal entry worksheet Prepare the adjusting entry for prepaid rent Prev 1d6 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts