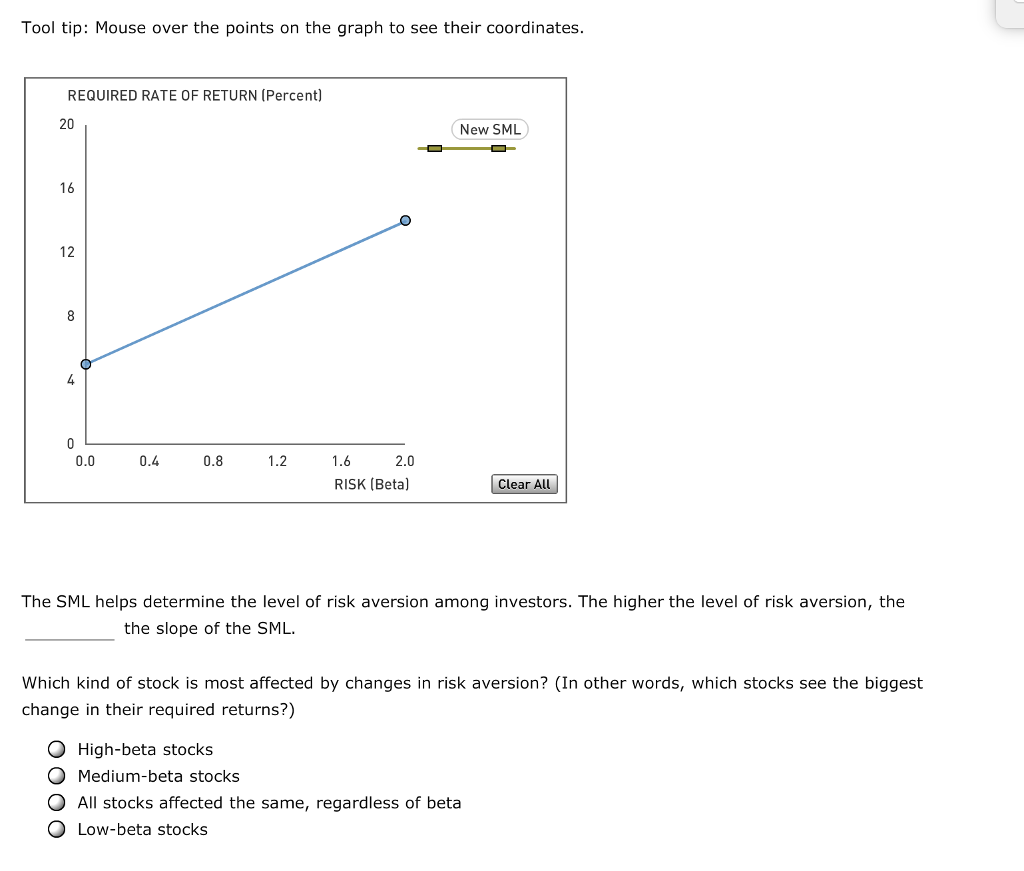

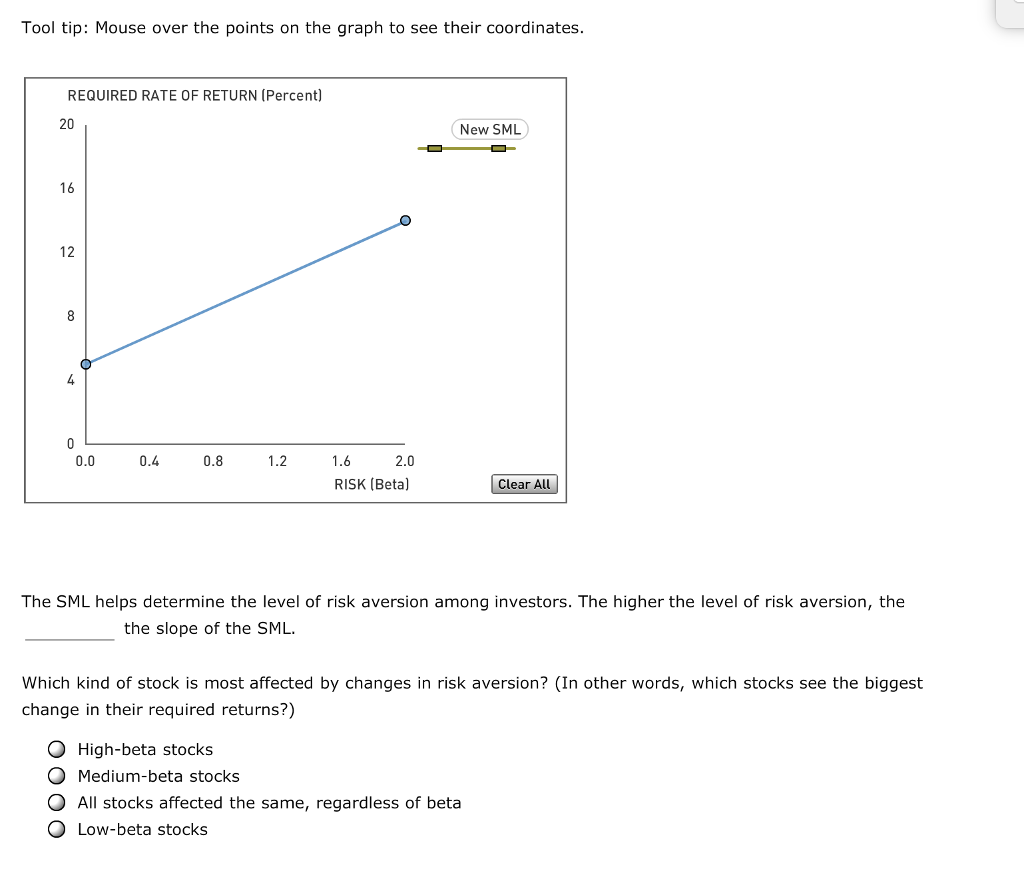

Question: Tool tip: Mouse over the points on the graph to see their coordinates. REQUIRED RATE OF RETURN (Percent) 20 New SML 16 12 0.0 0.4

Tool tip: Mouse over the points on the graph to see their coordinates. REQUIRED RATE OF RETURN (Percent) 20 New SML 16 12 0.0 0.4 0.8 1.2 1.6 2.0 RISK (Beta) Clear All The SML helps determine the level of risk aversion among investors. The higher the level of risk aversion, the the slope of the SML Which kind of stock is most affected by changes in risk aversion? (In other words, which stocks see the biggest change in their required returns?) O High-beta stocks O Medium-beta stocks O All stocks affected the same, regardless of beta O Low-beta stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts