Question: Tools Extensions Help Last edit was seconds ago al text Arial 11 + BIUA hali E 1E - - E-EE 2. +3 6 + 7

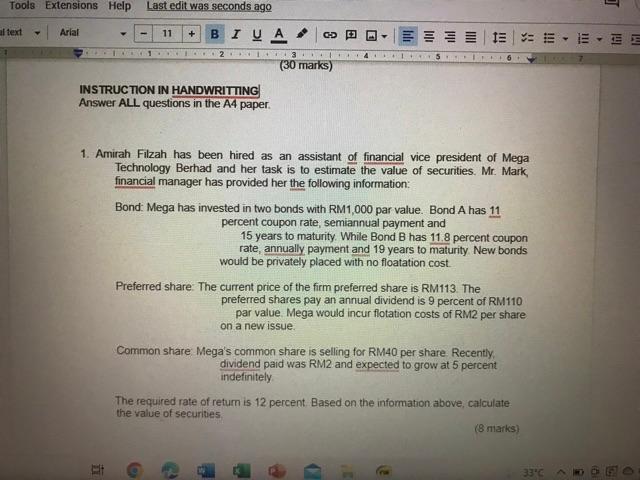

Tools Extensions Help Last edit was seconds ago al text Arial 11 + BIUA hali E 1E - - E-EE 2. +3 6 + 7 (30 marks) INSTRUCTION IN HANDWRITTING Answer ALL questions in the A4 paper 1. Amirah Filzah has been hired as an assistant of financial vice president of Mega Technology Berhad and her task is to estimate the value of securities. Mr. Mark financial manager has provided her the following information: Bond: Mega has invested in two bonds with RM1,000 par value. Bond A has 11 percent coupon rate, semiannual payment and 15 years to maturity. While Bond B has 11.8 percent coupon rate, annually payment and 19 years to maturity New bonds would be privately placed with no floatation cost Preferred share. The current price of the firm preferred share is RM113. The preferred shares pay an annual dividend is 9 percent of RM110 par value Mega would incur flotation costs of RM2 per share on a new issue Common share Mega's common share is selling for RM40 per share Recently, dividend paid was RM2 and expected to grow at 5 percent indefinitely The required rate of return is 12 percent. Based on the information above, calculate the value of securities (8 marks) ti G 330

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts