Question: Tools View Chapter 10 Assignment (1 ROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit it's safer to

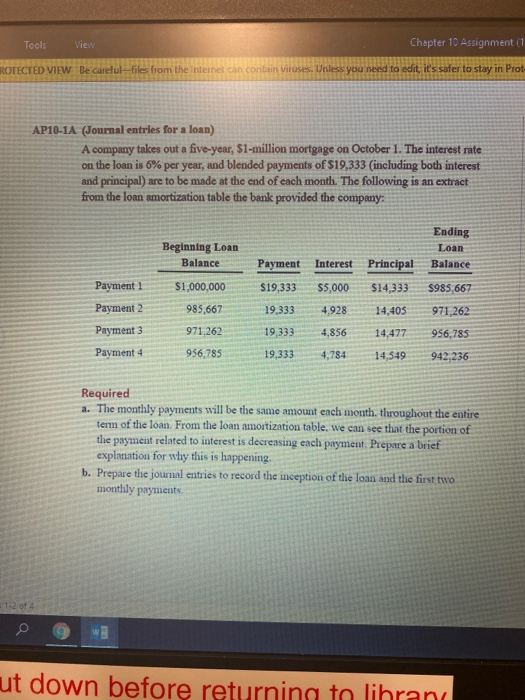

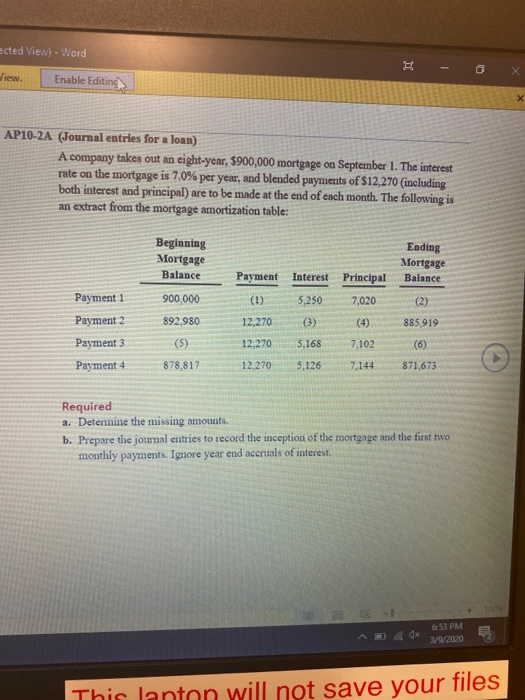

Tools View Chapter 10 Assignment (1 ROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Prot AP10-1A (Journal entries for a loan) A company takes out a five-year, S1-million mortgage on October 1. The interest rate on the loan is 6% per year, and blended payments of $19,333 (including both interest and principal) are to be made at the end of each month. The following is an extract from the loan amortization table the bank provided the company: Ending Beginning Loan Balance Loan Balance Payment Interest Principal Payment 1 $19,333 19,333 Payment 2 $1,000,000 985,667 971.262 956.785 $5,000 4,928 4,856 4,784 $14,333 14,405 14,477 14,549 $985,667 971,262 956,785 942,236 Payment 3 19,333 Payment 4 1 9,333 Required a. The monthly payments will be the same amount each month throughout the entire term of the loan. From the loan amortization table. we can see that the portion of the payment related to interest is decreasing each payment. Prepare a brief explanation for why this is happening b. Prepare the journal entries to record the inception of the loan and the first two monthly payments. 9 W ut down before returning to librand ected View) - Word 2 - 0 x view Enable Editing AP10-2A (Journal entries for a loan) A company takes out an eight-year, $900,000 mortgage on September 1. The interest rate on the mortgage is 7.0% per year, and blended payments of $12,270 (including both interest and principal) are to be made at the end of each month. The following is an extract from the mortgage amortization table: Beginning Mortgage Balance Ending Mortgage Balance Payment Interest Principal Payment 1 (1) 900,000 892,980 Payment 2 885919 5,250 (3) 5,168 5,126 12.270 12,270 12.270 7,020 (4) 7,102 7,144 Payment 3 (6) 871,673 Payment 4 878.817 Required a. Determine the missing amounts. b. Prepare the journal entries to record the inception of the mortgage and the first two monthly payments. Ignore year end accruals of interest. ^ T* 39/2020 This lanton will not save your files

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts