Question: Top Gun Construction Co . is evaluating two projects. Each project requires a $ 2 0 , 0 0 0 investment. Project x is the

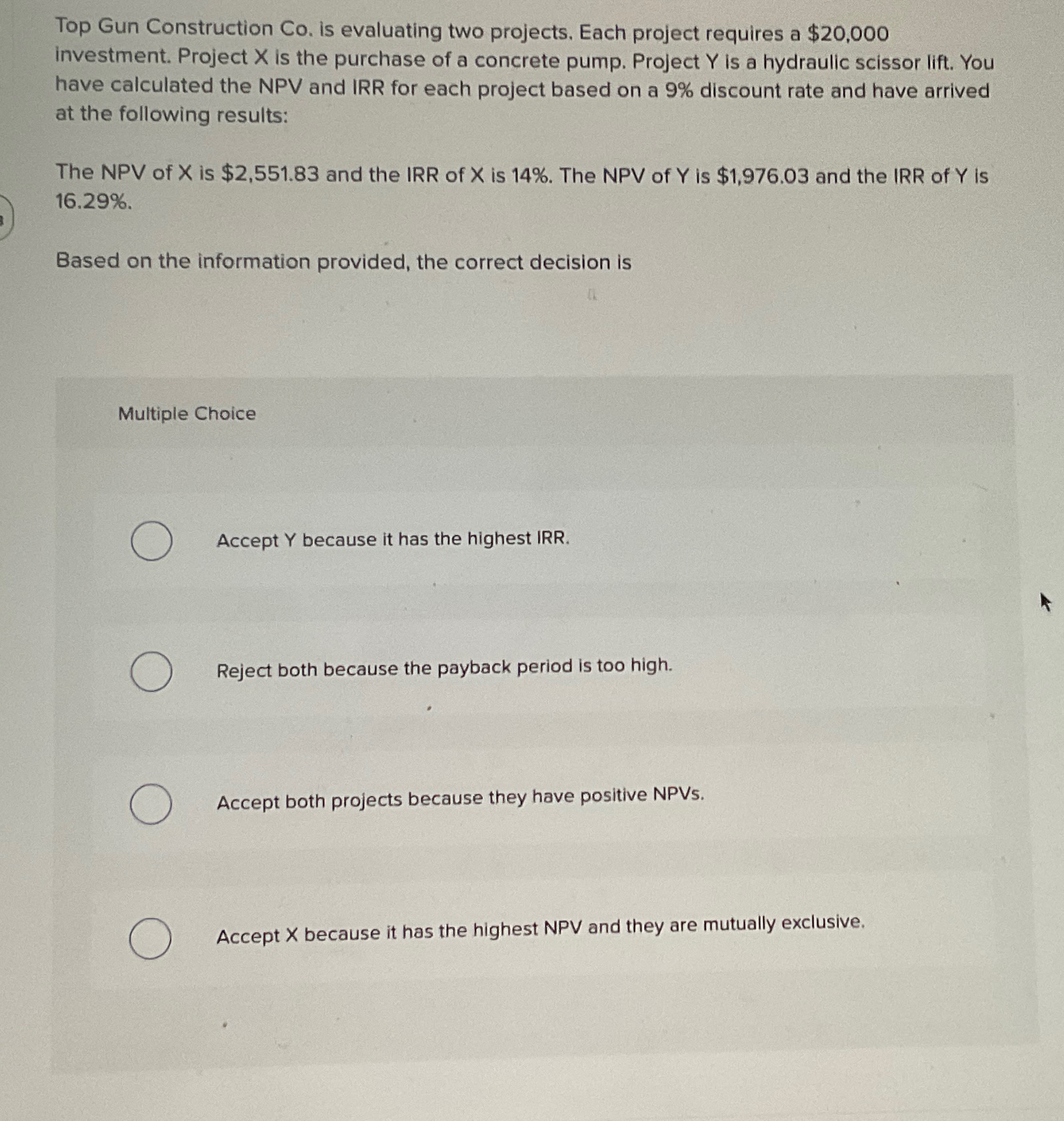

Top Gun Construction Co is evaluating two projects. Each project requires a $ investment. Project is the purchase of a concrete pump. Project is a hydraulic scissor lift. You have calculated the NPV and IRR for each project based on a discount rate and have arrived at the following results:

The NPV of is $ and the IRR of is The NPV of is $ and the IRR of is

Based on the information provided, the correct decision is

Multiple Choice

Accept because it has the highest IRR.

Reject both because the payback period is too high.

Accept both projects because they have positive NPVs

Accept because it has the highest NPV and they are mutually exclusive.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock