Question: TOPIC 4 TUTORIAL 4 1. Define the 3 forms of market efficiency. 2 A stock market analyst is able to identity misprices stocks by comparing

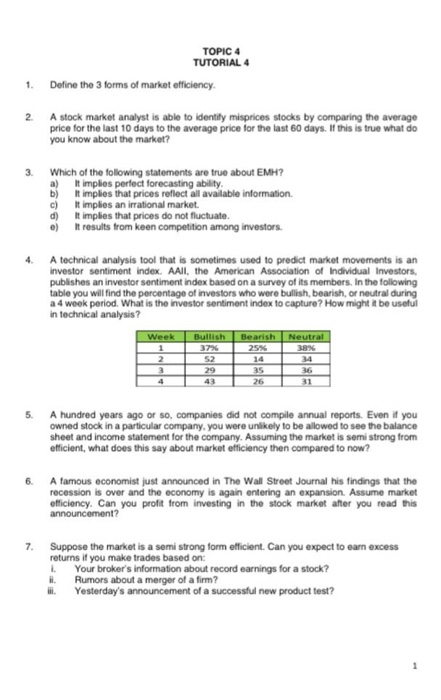

TOPIC 4 TUTORIAL 4 1. Define the 3 forms of market efficiency. 2 A stock market analyst is able to identity misprices stocks by comparing the average price for the last 10 days to the average price for the last 60 days. If this is true what do you know about the market? 3. Which of the following statements are true about EMH? a) It imples perfect forecasting ability b) It implies that prices reflect all available information c) It implies an irrational market. d) It implies that prices do not fluctuate. It results from keen competition among investors. e) 4. A technical analysis tool that is sometimes used to predict market movements is an investor sentiment index. All the American Association of Individual Investors, publishes an investor sentiment index based on a survey of its members. In the following table you will find the percentage of investors who were bullish, bearish, or neutral during a 4 week period. What is the investor sentiment index to capture? How might it be useful in technical analysis? Week 1 Bullish 37% Neutral 38% Bearish 25% 14 35 26 29 36 4 5 A hundred years ago or so, companies did not compile annual reports. Even if you owned stock in a particular company, you were unlikely to be allowed to see the balance sheet and income statement for the company. Assuming the market is semi strong from efficient, what does this say about market efficiency then compared to now? 6. A famous economist just announced in The Wall Street Journal his findings that the recession is over and the economy is again entering an expansion. Assume market efficiency. Can you profit from investing in the stock market after you read this announcement? 7 Suppose the market is a semi strong form efficient. Can you expect to earn excess returns if you make trades based on: i. Your broker's information about record earnings for a stock? Rumors about a merger of a firm? Yesterday's announcement nt of a successful new product test

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts