Question: Topic 5 Workshop Questions Last saved by user Compatibility Mode Saved to this PC Draw Design Layout References Mailings Review View Help Tell me what

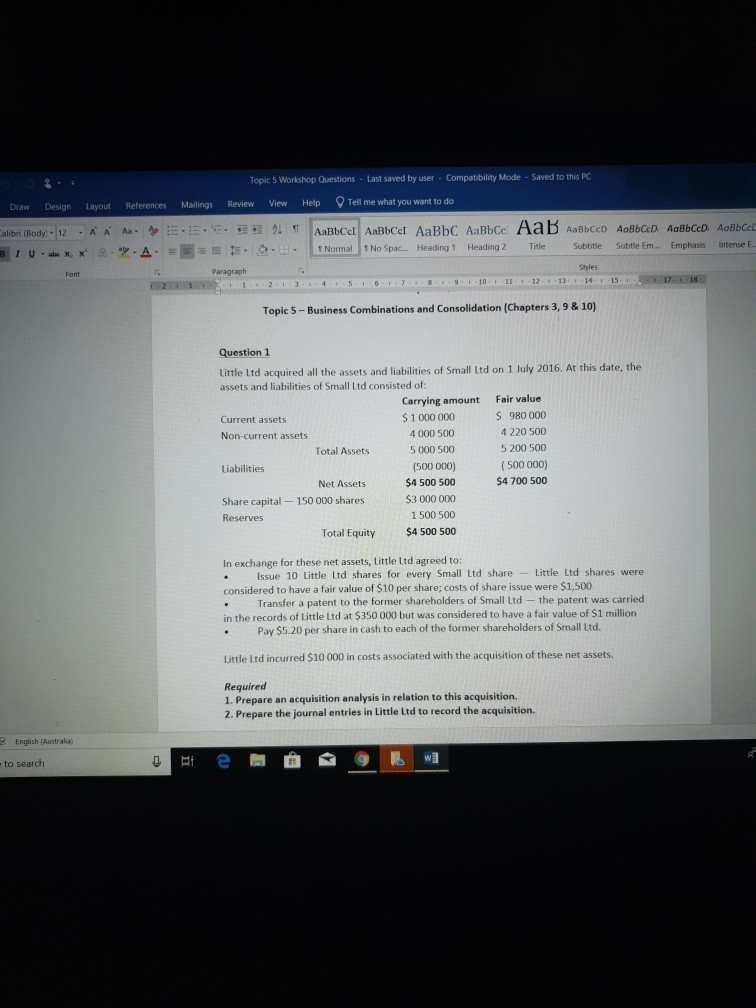

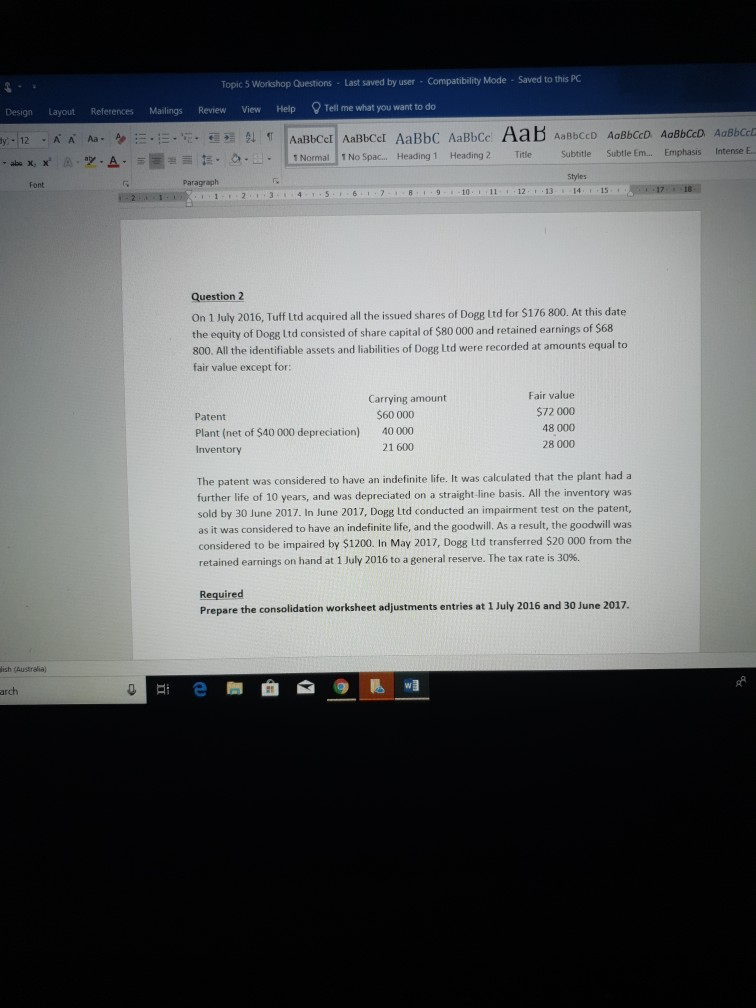

Topic 5 Workshop Questions Last saved by user Compatibility Mode Saved to this PC Draw Design Layout References Mailings Review View Help Tell me what you want to do , NormaNo Spae intense E Title Subtitle Sub tte Em. En phases , u_x,x' 2-= . a-L: . Heading 1 Heading 2 Styles 10. 12131 15 Topic 5-Business Combinations and Consolidation (Chapters 3, 9 & 10) Question 1 Little Ltd acquired all the assets and liabilities of Small Ltd on 1 July 2016. At this date, the assets and liabilities of Small Ltd consisted of: Carrying amount Fair value $ 1000000 4 000 500 5 000 500 S980 000 Current assets Non-current assets 4 220 500 5 200 500 (500 000) $4 700 500 Total Assets (500 000) $4 500 500 $3 000 000 1 500 500 $4 500 500 Liabilities Net Assets Share capital Reserves 10100 00 150 000 shares Total Equity In exchange for these net assets, Little Ltd agreed to .Issue 10 Little Ltd shares for every Small Ltd share Little Ltd shares were considered to have a fair value of $10 per share; costs of share issue were $1,500 Transfer a patent to the former shareholders of Small Ltd - the patent was carried in the records of Little Ltd at $350 000 but was considered to have a fair value of $1 million Pay $5.20 per share in cash to each of the former shareholders of Small Ltd. Little Ltd incurred $10 000 in costs associated with the acquisition of these net assets. Required 1. Prepare an acquisition analysis in relation to this acquisition. 2. Prepare the journal entries in Little Ltd to record the acquisition. English (Australia) e @+1 to search Topic 5 Workshop Questions Last saved by user Compatibility Mode - Saved to this PC Design Layout References Mailings Review View HelpTell me what you want to do 1 Normal 1 No Spac.. . Heading 1 Heading 2 Tite Subtitle Subtle Em... Emphasis Intense E Styles Font 5678910 1112 131411718 Question 2 On 1 July 2016, Tuff Ltd acquired all the issued shares of Dogg ltd for $176 800. At this date the equity of Dogg ltd consisted of share capital of $80 000 and retained earnings of $68 800. All the identifiable assets and liabilities of Dogg Ltd were recorded at amounts equal to fair value except for: Fair value $72 000 48 000 28 000 Carrying amount S60 000 Patent Plant (net of $40 000 depreciation) Inventory 40000 21 600 The patent was considered to have an indefinite life. It was calculated that the plant had a further life of 10 years, and was depreciated on a straight-line basis. All the inventory was sold by 30une 2017. In June 2017, Dogg ltd conducted an impairment test on the patent, as it was considered to have an indefinite life, and the goodwill. As a result, the goodwill was considered to be impaired by $1200. In May 2017, Dogg Ltd transferred $20 000 from the retained earnings on hand at 1 July 2016 to a general reserve. The tax rate is 30%. Required Prepare the consolidation worksheet adjustments entries at 1 July 2016 and 30 June 2017 ish (Australia) arch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts